Company Valuation Calculator

$1.99

1.9for iPhone, iPad and more

Global Business Strategies, Inc.

Developer

1.2 MB

Size

Aug 10, 2021

Update Date

Finance

Category

4+

Age Rating

Age Rating

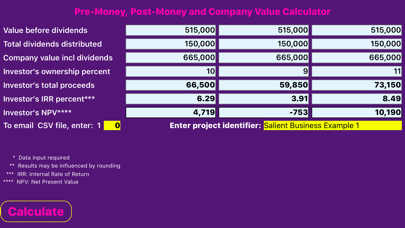

Company Valuation Calculator Screenshots

About Company Valuation Calculator

An educational experience for sophisticated users, CoValue, the Company Valuation Calculator, compares an investor's equity infusion, ownership demands and pre-money capital stock purchase offers to company counter offers. Employing an exit-year strategy, financial data, such as Earnings before interest, taxes, depreciation and amortization (EBITDA), is extended by the generally recognized multiple of earnings method to arrive at an exit year enterprise value for the company. Enterprise value is then adjusted for dividends received over the investment period, assets not included in the exit year transaction (such as investments) and current and long term liabilities that must be satisfied upon exit, to arrive at adjusted net proceeds. The investor's internal rate of return (irr) is then calculated by comparing the net proceeds available upon exit to the original investment. The investor's net present value is also calculated to determine investment feasibility based upon the investor's cost of capital.

The Company Valuation Calculator also provides a quick and easy method to perform sensitivity analyses for various levels of investments and ownership percentages. A comma separated value (.csv) file can be emailed from the app for reference and to perform additional spreadsheet analysis.

The Company Valuation Calculator also provides a quick and easy method to perform sensitivity analyses for various levels of investments and ownership percentages. A comma separated value (.csv) file can be emailed from the app for reference and to perform additional spreadsheet analysis.

Show More

What's New in the Latest Version 1.9

Last updated on Aug 10, 2021

Old Versions

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

Show More

Version History

1.9

Aug 10, 2021

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

1.8

Aug 4, 2021

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

1.7

Jan 9, 2020

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

1.6

Sep 17, 2019

Minor bug fixes and performance improvements

1.5

Sep 11, 2019

Bug fixes and performance improvements.

1.4

Dec 18, 2018

Minor bug fix.

1.3

Feb 2, 2018

Minor bug fixes

1.2

Dec 8, 2017

The Company Valuation Calculator was updated to generate a comma separated value (.csv) file of the financial project that can be emailed from the app for reference and to perform additional spreadsheet calculations.

1.1

Nov 30, 2017

Added investor's net present value calculation.

1.0

Nov 11, 2017

Company Valuation Calculator FAQ

Click here to learn how to download Company Valuation Calculator in restricted country or region.

Check the following list to see the minimum requirements of Company Valuation Calculator.

iPhone

Requires iOS 13.4 or later.

iPad

Requires iPadOS 13.4 or later.

iPod touch

Requires iOS 13.4 or later.

Company Valuation Calculator supports English