Ghana PAYE / SSNIT Calculator

Ghana PAYE (Tax) Calculator

$10.99

1.15.8for iPhone, iPad and more

Age Rating

Ghana PAYE / SSNIT Calculator Screenshots

About Ghana PAYE / SSNIT Calculator

Ghana PAYE Calculator calculates your Income Tax based on your Salary and SSNIT Contribution (5.5%) and gives you an accurate representation of what you are to pay. This part is useful for everybody. The User Interface is neatly designed and easy to use.

It is built using the latest Tax Rates from Ghana Revenue Authority ( GRA ).

If you are a student or a lecturer, employer or employee or just an ordinary citizen interested in knowing how much your SSNIT Contribution or Income Tax Deduction (PAYE) is calculated and how much you ought to pay, this application will put you in the right direction.

Features:

1. Quick Calculations

2. Detailed Calculations

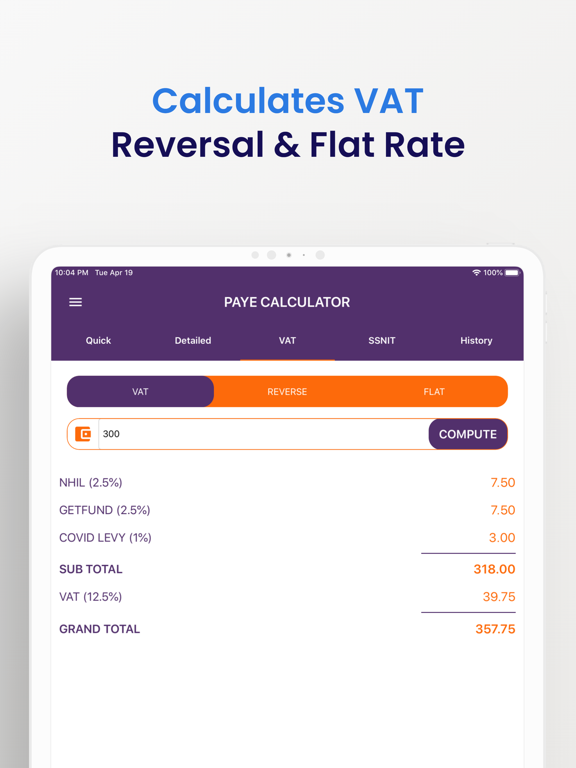

3. Calculates VAT on goods and services (VAT, VAT Reversal, and VAT Flat Rate)

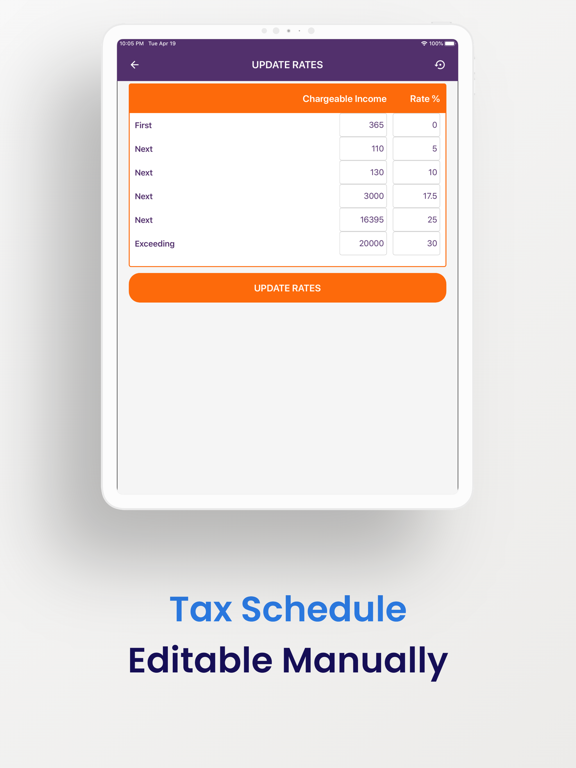

4. Custom Tax schedule (Includes previous tax schedules)

5. Easy to use interface

6. Calculates Net to Gross Salary and Gross to Net

7. Overtime tax, Bonus Tax, Tier 1, Tier2 and Tier 3 (Provident Fund) Calculations

8. Net to Gross Salary Calculation

9. Tourism Levy Calculation

It is built using the latest Tax Rates from Ghana Revenue Authority ( GRA ).

If you are a student or a lecturer, employer or employee or just an ordinary citizen interested in knowing how much your SSNIT Contribution or Income Tax Deduction (PAYE) is calculated and how much you ought to pay, this application will put you in the right direction.

Features:

1. Quick Calculations

2. Detailed Calculations

3. Calculates VAT on goods and services (VAT, VAT Reversal, and VAT Flat Rate)

4. Custom Tax schedule (Includes previous tax schedules)

5. Easy to use interface

6. Calculates Net to Gross Salary and Gross to Net

7. Overtime tax, Bonus Tax, Tier 1, Tier2 and Tier 3 (Provident Fund) Calculations

8. Net to Gross Salary Calculation

9. Tourism Levy Calculation

Show More

What's New in the Latest Version 1.15.8

Last updated on Jan 25, 2024

Old Versions

Tax Schedule Updated with 2024 Rates

Show More

Version History

1.15.8

Jan 25, 2024

Tax Schedule Updated with 2024 Rates

1.15.6

Apr 27, 2023

Update to April 2023 Tax Rates. You can also check or change the rate by going to the left menu and selecting Edit Tax Rates.

1.14.6

Mar 11, 2023

Minor improvements

1.13.6

Jan 20, 2023

Added Option to Choose between 2022 PAYE Rate and 2023. Default set to 2022

1.12.5

Jan 18, 2023

Update to PAYE, VAT effective 2023

1.11.5

Jan 16, 2023

Updated with the New PAYE Rate of 2023 and improved Net to Gross Salary reversal formula

1.10.4

Dec 31, 2022

Updated VAT new rate effective 1st January 2023

Updated Reverse VAT calculation to include Tourism levy

Other bug fixes and improvements

Updated Reverse VAT calculation to include Tourism levy

Other bug fixes and improvements

1.9.4

Dec 2, 2022

Fixed error Detailed Net salary cutting off

1.8.4

Dec 1, 2022

We Added Calculation of Tourism levy to the VAT Module, and updated the Net to gross (Reverse salary) Computation to be faster, and works offline now

1.7.4

Aug 3, 2022

We update calculation of Bonus and Overtime

1.6.4

Jul 16, 2022

Added tax relief calculation to the detailed tab

1.5.4

Apr 21, 2022

We update the application from time to time to give you the best experience. In this release, we introduced a Side menu with more options to aid you in the digitization agenda. This includes E-levy Calculator, links to File and pay your taxes online, verify your tin, Ghancard to SSNIT Merger options and more.

1.4.4

Jan 17, 2022

Implemented New Tax schedules, bonuses, overtime, Tier 2 and provident fund (tier 3).

Fixed an issue with detailed mode calculation where tax is not displaying and exclude SSNIT was not working.

Other bug fixes

Fixed an issue with detailed mode calculation where tax is not displaying and exclude SSNIT was not working.

Other bug fixes

1.3.2

Jan 15, 2022

Updated the Tax Schedule to the latest Amendment issued by GRA effective 1st January 2022

1.2.1

Jul 8, 2020

You can now do your VAT calculation for goods and services using the new method, and we also made some minor improvements for your user experience.

1.1.1

Feb 13, 2020

Fixed: Bug in calculating Annual Income Figures

Other Bug Fixes and improvements

Other Bug Fixes and improvements

1.0

Feb 7, 2020

Ghana PAYE / SSNIT Calculator FAQ

Click here to learn how to download Ghana PAYE / SSNIT Calculator in restricted country or region.

Check the following list to see the minimum requirements of Ghana PAYE / SSNIT Calculator.

iPhone

Requires iOS 11.0 or later.

iPad

Requires iPadOS 11.0 or later.

iPod touch

Requires iOS 11.0 or later.

Ghana PAYE / SSNIT Calculator supports English