Mileage Log for Driver & Rider

Free

3.0for iPhone

Age Rating

Mileage Log for Driver & Rider Screenshots

About Mileage Log for Driver & Rider

Key Features:

• Auto-detection – automatically detects when you are driving, and starts recording/logging your trip

• Automatic GPS tracking or manual entry for mileage

• GPS tracking auto-fills in location information and calculates distance traveled for each trip

• Tax-compliant expense reports for mileage rates

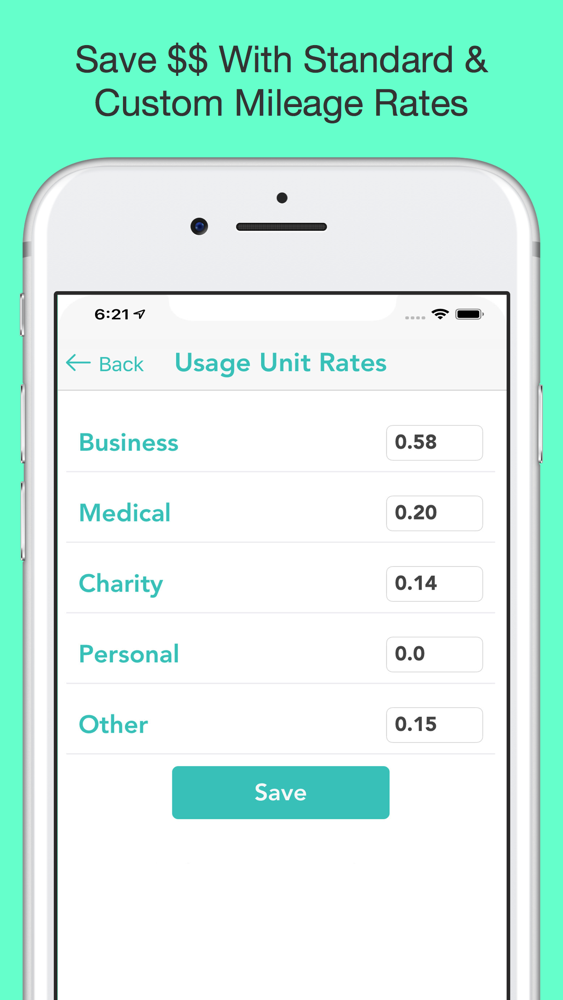

• Supports Standard & Custom mileage rates

• Most drivers save $6,900 per year (on average)

• Cloud sync - No need to worry about losing your trips if you lose your phone. A single click will save all your trips to iCloud

• Sync to iCloud, so you can manage your trips on multiple devices

• Categorize business vs. personal miles with one swipe (or pre-set your desired category, and Miles app does everything else for you)

• Swipe right to categorize as Business trip. Swipe left for Personal

• Record and edit trips, produce a logbook and maximize your tax deductions and reimbursements

• Produce maps of your driving routes

• A 10-mile business drive earns you $5.80 in deductions, more than the cost of Miles for one month

• Your Miles subscriptions can be reimbursed or tax-deducted as a business expense

• Snap and save photos of receipts and tag those receipts with a description, time and date

• Dashboard tracks and reports on business income, expense, and profit

• Filter reports by business uses (e.g., Lyft, Uber, Airbnb) or private use

• Email logbook as a CSV text file to your accountant, work, or financial specialist, whenever you need to (for importing directly into spreadsheet)

• Data export – you filter desired data, and the app will export into CSV file, and create email for you. All you do is push SEND to your accountant. CSV files allow you or your accountant easily import your data, and open in any of your spreadsheet applications

• Support for multiple vehicles, and quick trip description selection

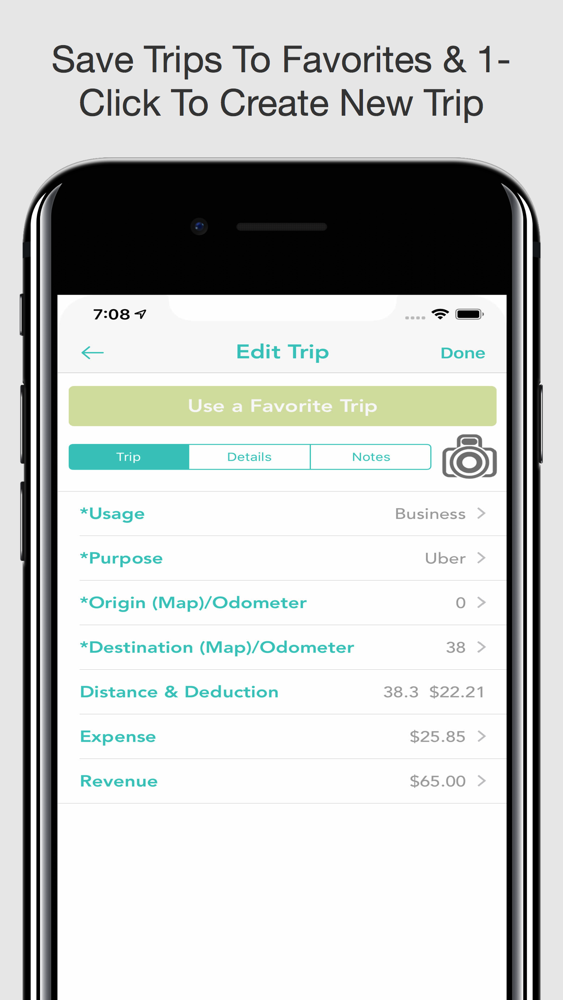

• Save your favorite trips and addresses, and reuse with a single click – a huge time-saving for you

• Log your expenses – Meals (for Rideshare/Uber/Lyft drivers), Tolls, parking, maintenance, registration, etc

• Support for multiple currencies

• Support for miles or kilometers

• Track and manage multiple vehicles and drivers

• Log trip details - (photo of receipt, odometer, date/time, purpose, usage, origin, destination, vehicle, driver, notes)

Download Miles Today and Start Saving!

We love feedback from you! Send us ideas and feedback at support@anode.com.au

Battery Usage:

Miles is optimized to consume as little battery power as possible, even while GPS auto-tracking is active.

Privacy Policy: http://www.anode.com.au/privacy

• Auto-detection – automatically detects when you are driving, and starts recording/logging your trip

• Automatic GPS tracking or manual entry for mileage

• GPS tracking auto-fills in location information and calculates distance traveled for each trip

• Tax-compliant expense reports for mileage rates

• Supports Standard & Custom mileage rates

• Most drivers save $6,900 per year (on average)

• Cloud sync - No need to worry about losing your trips if you lose your phone. A single click will save all your trips to iCloud

• Sync to iCloud, so you can manage your trips on multiple devices

• Categorize business vs. personal miles with one swipe (or pre-set your desired category, and Miles app does everything else for you)

• Swipe right to categorize as Business trip. Swipe left for Personal

• Record and edit trips, produce a logbook and maximize your tax deductions and reimbursements

• Produce maps of your driving routes

• A 10-mile business drive earns you $5.80 in deductions, more than the cost of Miles for one month

• Your Miles subscriptions can be reimbursed or tax-deducted as a business expense

• Snap and save photos of receipts and tag those receipts with a description, time and date

• Dashboard tracks and reports on business income, expense, and profit

• Filter reports by business uses (e.g., Lyft, Uber, Airbnb) or private use

• Email logbook as a CSV text file to your accountant, work, or financial specialist, whenever you need to (for importing directly into spreadsheet)

• Data export – you filter desired data, and the app will export into CSV file, and create email for you. All you do is push SEND to your accountant. CSV files allow you or your accountant easily import your data, and open in any of your spreadsheet applications

• Support for multiple vehicles, and quick trip description selection

• Save your favorite trips and addresses, and reuse with a single click – a huge time-saving for you

• Log your expenses – Meals (for Rideshare/Uber/Lyft drivers), Tolls, parking, maintenance, registration, etc

• Support for multiple currencies

• Support for miles or kilometers

• Track and manage multiple vehicles and drivers

• Log trip details - (photo of receipt, odometer, date/time, purpose, usage, origin, destination, vehicle, driver, notes)

Download Miles Today and Start Saving!

We love feedback from you! Send us ideas and feedback at support@anode.com.au

Battery Usage:

Miles is optimized to consume as little battery power as possible, even while GPS auto-tracking is active.

Privacy Policy: http://www.anode.com.au/privacy

Show More

What's New in the Latest Version 3.0

Last updated on Nov 22, 2019

Old Versions

Remember: your subscription for this app can be reimbursed or tax-deducted as a business expense. Thanks for using Miles - the mileage log tracker for drivers and riders! Here's an update to keep you maximizing those tax deductions and reimbursements.

Show More

Version History

3.0

Nov 22, 2019

Remember: your subscription for this app can be reimbursed or tax-deducted as a business expense. Thanks for using Miles - the mileage log tracker for drivers and riders! Here's an update to keep you maximizing those tax deductions and reimbursements.

Mileage Log for Driver & Rider FAQ

Click here to learn how to download Mileage Log for Driver & Rider in restricted country or region.

Check the following list to see the minimum requirements of Mileage Log for Driver & Rider.

iPhone

Mileage Log for Driver & Rider supports English