My Tax India

Free

2.1.4for iPhone, iPod touch

5.3

7 Ratings

Quintet Solutions Pvt Ltd

Developer

24.5 MB

Size

Apr 12, 2023

Update Date

Finance

Category

4+

Age Rating

Age Rating

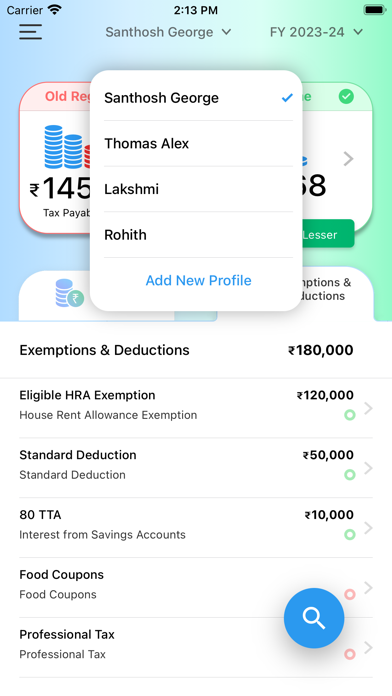

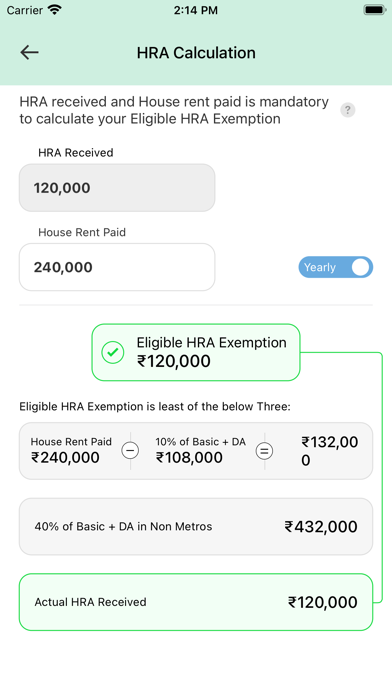

My Tax India Screenshots

About My Tax India

Tax calculation has never been so easy and fun! Efficient tax calculation and planning made possible for FREE!!! When most of the taxpayers find tax computation and tax planning very complex, My Tax India enables assessees to do these with it's simple and powerful interface. Union budget 2020 has put forth two tax regimes to choose from, and with MyTax India, be it the new regime or the old, it's just a walk in the park to foresee the tax liability and make better use of tax saving instruments. With My TaxIndia advanced user interface and tools, tax payers understand the Income Tax calculation and Tax saving opportunities so as to choose the best suited from the old and the new tax regimes.

Have fun using "My Tax India".

Have fun using "My Tax India".

Show More

What's New in the Latest Version 2.1.4

Last updated on Apr 12, 2023

Old Versions

Tax calculation has never been so easy and fun! Efficient tax calculation and planning for the financial year 2023 - 2024 made possible for FREE!!! When most of the taxpayers find tax computation and tax planning very complex, My Tax India enables assessees to do these with it's simple and powerful interface. Union budget 2020 has put forth two tax regimes to choose from, and with MyTax India, be it the new regime or the old, it's just a walk in the park to foresee the tax liability and make better use of tax saving instruments. With My TaxIndia advanced user interface and tools, tax payers understand the Income Tax calculation and Tax saving opportunities so as to choose the best suited from the old and the new tax regimes.

Show More

Version History

2.1.4

Apr 12, 2023

Tax calculation has never been so easy and fun! Efficient tax calculation and planning for the financial year 2023 - 2024 made possible for FREE!!! When most of the taxpayers find tax computation and tax planning very complex, My Tax India enables assessees to do these with it's simple and powerful interface. Union budget 2020 has put forth two tax regimes to choose from, and with MyTax India, be it the new regime or the old, it's just a walk in the park to foresee the tax liability and make better use of tax saving instruments. With My TaxIndia advanced user interface and tools, tax payers understand the Income Tax calculation and Tax saving opportunities so as to choose the best suited from the old and the new tax regimes.

2.1.3

Feb 10, 2023

Tax calculation has never been so easy and fun! Efficient tax calculation and planning for the financial year 2023 - 2024 made possible for FREE!!! When most of the taxpayers find tax computation and tax planning very complex, My Tax India enables assessees to do these with it's simple and powerful interface. Union budget 2020 has put forth two tax regimes to choose from, and with MyTax India, be it the new regime or the old, it's just a walk in the park to foresee the tax liability and make better use of tax saving instruments. With My TaxIndia advanced user interface and tools, tax payers understand the Income Tax calculation and Tax saving opportunities so as to choose the best suited from the old and the new tax regimes.

2.1.2

Feb 2, 2023

Tax calculation has never been so easy and fun! Efficient tax calculation and planning for the financial year 2023 - 2024 made possible for FREE!!! When most of the taxpayers find tax computation and tax planning very complex, My Tax India enables assessees to do these with it's simple and powerful interface. Union budget 2020 has put forth two tax regimes to choose from, and with MyTax India, be it the new regime or the old, it's just a walk in the park to foresee the tax liability and make better use of tax saving instruments. With My TaxIndia advanced user interface and tools, tax payers understand the Income Tax calculation and Tax saving opportunities so as to choose the best suited from the old and the new tax regimes.

2.1.1

Oct 12, 2022

* You can now add multiple tax profiles. Go ahead and calculate tax for your loved one's too.

* You can now delete your account

* Minor bug fixes and UI optimizations

* You can now delete your account

* Minor bug fixes and UI optimizations

2.1.0

Sep 30, 2022

* You can now add multiple tax profiles. Go ahead and calculate tax for your loved one's too.

* You can now delete your account

* Minor bug fixes and UI optimizations

* You can now delete your account

* Minor bug fixes and UI optimizations

2.0.5

Feb 1, 2022

New tax rules for FY 2022-2023 implemented along with new Regime and Old Regime Comparison.

2.0.4

Oct 11, 2021

iOS 15 compatibility

2.0.3

Jun 4, 2021

Lock Screen introduced

2.0.2

Jun 2, 2021

Lock Screen introduced

2.0.1

Feb 4, 2021

New tax rules for FY 2021-2022 implemented along with new Regime and Old Regime Comparison.

2.0.0

Dec 19, 2020

New tax rules for FY 2020-2021 implemented along with new Regime and Old Regime Comparison.

1.9.7

Sep 4, 2019

Union Budget, July 5th - 2019 (Govt: NDA, Finance Minister: Nirmala Sitharaman).

1) Standard tax deduction for salaried persons raised from 40,000 to 50,000.

2) Individual taxpayers with annual taxable income up to 5 lakh rupees to get the full tax rebate.

3) Exemption for interest on Loan taken for purchase of Electric vehicle (80EEB)

1) Standard tax deduction for salaried persons raised from 40,000 to 50,000.

2) Individual taxpayers with annual taxable income up to 5 lakh rupees to get the full tax rebate.

3) Exemption for interest on Loan taken for purchase of Electric vehicle (80EEB)

1.9.6

Apr 2, 2019

Interim Union Budget, February 1st - 2019 (Govt: NDA, Finance Minister: Arun Jaitley, Budget Presented by : Piyush Goyal).

1) Standard tax deduction for salaried persons raised from 40,000 to 50,000.

2) Individual taxpayers with annual taxable income up to 5 lakh rupees to get the full tax rebate.

1) Standard tax deduction for salaried persons raised from 40,000 to 50,000.

2) Individual taxpayers with annual taxable income up to 5 lakh rupees to get the full tax rebate.

1.9.5

Nov 29, 2018

Union Budget, February 1st - 2018 (Govt: NDA, Finance Minister: Arun Jaitley).

Standard Deductions for salaried and pensioners added from AY 2019-20.

Standard Deductions for salaried and pensioners added from AY 2019-20.

1.9.4

Jul 14, 2017

Union Budget, February 1st - 2017 (Govt: NDA, Finance Minister: Arun Jaitley)

1.9.3

Apr 22, 2016

Union Budget, February 29th -2016 (Govt: NDA, Finance Minister: Arun Jaitley)

1.9.2

Apr 6, 2016

Union Budget, February 29th -2016 (Govt: NDA, Finance Minister: Arun Jaitley)

1.9.1

Mar 24, 2015

Union Budget, February 28th -2015 (Govt: NDA, Finance Minister: Arun Jaitley)

1.9

Aug 16, 2014

Union Budget, July 10th -2014 (Govt: NDA, Finance Minister: Arun Jaitley)

Changes -

1. Personal tax exemption limit increased from the current Rs 2 lakhs to Rs 2.5 lakhs.

2. Income tax exemption limit for senior citizens has been raised to Rs 3 lakhs.

3. Investment limit under Section 80C has been hiked from current 1 lakh to Rs 1.5 lakhs.

4. Housing loan interest exemption has also been increased from Rs 1.5 lakhs to Rs 2 lakhs.

5. Bug fix

Changes -

1. Personal tax exemption limit increased from the current Rs 2 lakhs to Rs 2.5 lakhs.

2. Income tax exemption limit for senior citizens has been raised to Rs 3 lakhs.

3. Investment limit under Section 80C has been hiked from current 1 lakh to Rs 1.5 lakhs.

4. Housing loan interest exemption has also been increased from Rs 1.5 lakhs to Rs 2 lakhs.

5. Bug fix

1.8

Jul 23, 2014

Union Budget, July 10th -2014 (Govt: NDA, Finance Minister: Arun Jaitley)

Changes -

1. Personal tax exemption limit increased from the current Rs 2 lakhs to Rs 2.5 lakhs.

2. Income tax exemption limit for senior citizens has been raised to Rs 3 lakhs.

3. Investment limit under Section 80C has been hiked from current 1 lakh to Rs 1.5 lakhs.

4. Housing loan interest exemption has also been increased from Rs 1.5 lakhs to Rs 2 lakhs.

5. Bug fix

Changes -

1. Personal tax exemption limit increased from the current Rs 2 lakhs to Rs 2.5 lakhs.

2. Income tax exemption limit for senior citizens has been raised to Rs 3 lakhs.

3. Investment limit under Section 80C has been hiked from current 1 lakh to Rs 1.5 lakhs.

4. Housing loan interest exemption has also been increased from Rs 1.5 lakhs to Rs 2 lakhs.

5. Bug fix

1.7

Jul 14, 2014

Union Budget, July 10th -2014 (Govt: NDA, Finance Minister: Arun Jaitley)

Changes -

1. Personal tax exemption limit increased from the current Rs 2 lakhs to Rs 2.5 lakhs.

2. Income tax exemption limit for senior citizens has been raised to Rs 3 lakhs.

3. Investment limit under Section 80C has been hiked from current 1 lakh to Rs 1.5 lakhs.

4. Housing loan interest exemption has also been increased from Rs 1.5 lakhs to Rs 2 lakhs.

Changes -

1. Personal tax exemption limit increased from the current Rs 2 lakhs to Rs 2.5 lakhs.

2. Income tax exemption limit for senior citizens has been raised to Rs 3 lakhs.

3. Investment limit under Section 80C has been hiked from current 1 lakh to Rs 1.5 lakhs.

4. Housing loan interest exemption has also been increased from Rs 1.5 lakhs to Rs 2 lakhs.

1.6

Mar 22, 2014

New assessment year added (2015-2016)

1.5

Apr 1, 2013

New assessment year added (2014-2015)

1.4

Mar 22, 2013

New assessment year added (2014-2015)

1.3

Mar 27, 2012

New assessment year added (2013-2014)

My Tax India FAQ

Click here to learn how to download My Tax India in restricted country or region.

Check the following list to see the minimum requirements of My Tax India.

iPhone

Requires iOS 15.0 or later.

iPod touch

Requires iOS 15.0 or later.

My Tax India supports English