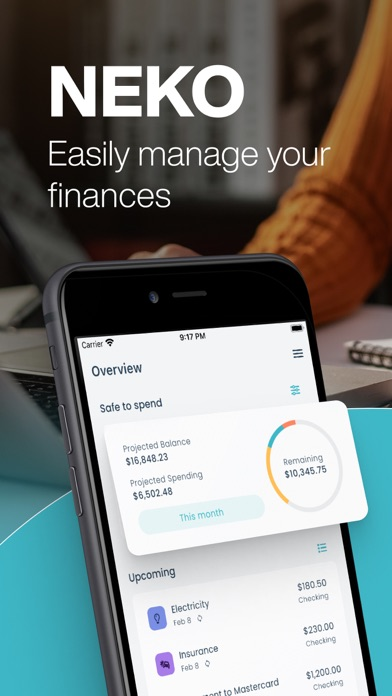

Neko: Bills & Spending Tracker

Budget Planner & Money Manager

FreeOffers In-App Purchases

7.6.0for iPhone, iPad and more

Age Rating

Neko: Bills & Spending Tracker Screenshots

About Neko: Bills & Spending Tracker

With Neko, you can easily:

1. Enter your paycheck schedule and amount to automatically update your account balance every payday. No more manually updating your balance or worrying about missing a paycheck.

2. Add all of your accounts, including checking, savings, and even cash, to get a complete picture of your financial situation. No need to connect with your bank, just set your initial balance and Neko will deduct from it when adding a transaction or paying a bill or add to it when it's payday!

3. Set bill due dates and never miss a payment again with our reminders feature. No more late fees or impacting your credit score.

4. Track your expenses to gain insight into your spending habits and better control your budget. You'll be able to see where your money is going and make adjustments as necessary.

5. Compare your income and expenses with our chart feature to ensure you're not overspending. This feature will help you to make sure you're sticking to your budget and saving enough money.

6. And best of all, Neko is completely private and doesn't require a connection to your bank account. You can track your money the way you want and keep your financial information safe and secure.

Neko comes with great features such as

- Recurring bills

- Bills payment reminders

- Spending tracking

- Income management

- Account balance tracking

- Calendar

- Insights with helpful charts

It's the perfect tool to help you build the habit of tracking and controlling your spending. It tells you how much money you have left after paying your bills so you can start saving or spend it however you want without worries.

Don't let your finances control you. Take control of your finances with Neko. Our app is very easy to use, making it the perfect tool for anyone looking to get a handle on their money. So why wait? Download Neko now and start taking control of your finances today!

1. Enter your paycheck schedule and amount to automatically update your account balance every payday. No more manually updating your balance or worrying about missing a paycheck.

2. Add all of your accounts, including checking, savings, and even cash, to get a complete picture of your financial situation. No need to connect with your bank, just set your initial balance and Neko will deduct from it when adding a transaction or paying a bill or add to it when it's payday!

3. Set bill due dates and never miss a payment again with our reminders feature. No more late fees or impacting your credit score.

4. Track your expenses to gain insight into your spending habits and better control your budget. You'll be able to see where your money is going and make adjustments as necessary.

5. Compare your income and expenses with our chart feature to ensure you're not overspending. This feature will help you to make sure you're sticking to your budget and saving enough money.

6. And best of all, Neko is completely private and doesn't require a connection to your bank account. You can track your money the way you want and keep your financial information safe and secure.

Neko comes with great features such as

- Recurring bills

- Bills payment reminders

- Spending tracking

- Income management

- Account balance tracking

- Calendar

- Insights with helpful charts

It's the perfect tool to help you build the habit of tracking and controlling your spending. It tells you how much money you have left after paying your bills so you can start saving or spend it however you want without worries.

Don't let your finances control you. Take control of your finances with Neko. Our app is very easy to use, making it the perfect tool for anyone looking to get a handle on their money. So why wait? Download Neko now and start taking control of your finances today!

Show More

What's New in the Latest Version 7.6.0

Last updated on Mar 30, 2024

Old Versions

Improvements for tablets

Show More

Version History

7.6.0

Mar 30, 2024

Improvements for tablets

7.5.0

Mar 23, 2024

Upcoming Card

- Add filters by account, category and type to upcoming screen

- Rename the "Until payday" to "Before payday" so it's clearer

NEW! Refunds

- Add refunds for accounts and credit cards

Calendar

- Now you can switch between views with a button on the top right of the calendar

- Transactions list

- Projected balance

- Month summary

Bug fixes

- Fix custom date being moved to next day in the Safe to spend card when reopening the app

- Fix expenses in the future updating account balance when being deleted

- Add filters by account, category and type to upcoming screen

- Rename the "Until payday" to "Before payday" so it's clearer

NEW! Refunds

- Add refunds for accounts and credit cards

Calendar

- Now you can switch between views with a button on the top right of the calendar

- Transactions list

- Projected balance

- Month summary

Bug fixes

- Fix custom date being moved to next day in the Safe to spend card when reopening the app

- Fix expenses in the future updating account balance when being deleted

7.4.0

Mar 13, 2024

Reminders

- Add pay reminder option for "7 days before"

- Add reminder for past due bills.

Calendar

- Show the list of transactions at the bottom of the calendar

- Add button for going back to "Today" in the calendar

Account Summary

- Fix transactions list not updating correctly

- Sort transactions in descending order in the "See all transactions"

- Add pay reminder option for "7 days before"

- Add reminder for past due bills.

Calendar

- Show the list of transactions at the bottom of the calendar

- Add button for going back to "Today" in the calendar

Account Summary

- Fix transactions list not updating correctly

- Sort transactions in descending order in the "See all transactions"

7.3.0

Mar 2, 2024

Safe to Spend

- Add the current balance

- Fix some the Projected Spending label cutting off on some devices

- Fix bug when setting the period on the full screen not updating the card period

- Removing the expandable sections from the full screen view, making it easier to see the calculation breakdown

- Add indicator icon for remaining amount

Recurring transactions

- Remove expandable categories on the bills card to make it easier to view

Minor bug fixes

- Add the current balance

- Fix some the Projected Spending label cutting off on some devices

- Fix bug when setting the period on the full screen not updating the card period

- Removing the expandable sections from the full screen view, making it easier to see the calculation breakdown

- Add indicator icon for remaining amount

Recurring transactions

- Remove expandable categories on the bills card to make it easier to view

Minor bug fixes

7.2.0

Feb 25, 2024

- Add "Recent Transactions" card to Overview tab

- Fix bug with credit card payments amount being updated to latest balance after posted when paid early.

- Fix bug with credit card payments amount being updated to latest balance after posted when paid early.

7.1.4

Feb 20, 2024

- Fix bill notifications not cancelled when paying a bill early.

- Fix credit card payment notifications not showing up.

- Fix credit card payment notifications not showing up.

7.1.1

Feb 13, 2024

Fixed some minor bugs

7.1.0

Feb 12, 2024

Thanks everyone for your feedback, I am working really hard to make this app better and your input helps me a lot.

- Now you can filter the entries in the calendar by account and transaction type!

- Added projected balance to the calendar.

- Added totals to upcoming and transaction search screens.

- Fixed a bug that duplicated income entries in the past when updating an existing recurring income.

- Now you can filter the entries in the calendar by account and transaction type!

- Added projected balance to the calendar.

- Added totals to upcoming and transaction search screens.

- Fixed a bug that duplicated income entries in the past when updating an existing recurring income.

7.0.0

Feb 6, 2024

I'm really excited about this update, it includes many improvements and love for the app. Thanks to everyone who sent feedback and suggestions, it really helps me improving the app.

I am adding some identity to the app and now it has a name "NEKO" and a new icon that I hope you like.

IMPROVEMENTS

- Recurring transfers: Just as the recurring bills, now you can create recurring transfers to move money between your accounts.

- Undo payment: You can now undo a payment for bills, income, transfers or expenses.

- Income auto-post: You can now set each income individually to be automatically posted on payday.

- Expense in the future: If you enter a expense in the future, it will be scheduled but it won't affect your balance until is posted.

- Upcoming card now shows all the upcoming transactions, including bills, income, transfers and expenses.

- Account summary now includes your upcoming and recent transactions.

- Added "Next month" to the period filter options.

SAFE TO SPEND

- You can now filter the accounts and transaction types you want to include in the calculation.

- When you tap the safe to spend card, it opens a new screen with details on how it was calculated. You can see the breakdown by account as well.

NEW LAYOUT

The app content was reorganized to make it more intuitive and easier to navigate, now it includes the following tabs:

- Overview: See at a glance how much you can spend and what are your upcoming payments.

- Transactions: Visualize your transactions by month on the calendar or list views.

- Accounts: See your accounts categorized by type, for now "Deposit accounts" and "Credit cards"; more to come!

- Insights: I added more helpful charts for you and categorized them by cash flow, spending, income and credit cards. I will be adding more charts soon!

CREDIT CARDS

- New "Auto-Pay" feature that schedules a payment for every month's due date for your credit card.

- Track your credit usage across all your credit cards to help you keep a healthy %

MENU

- Recurring transactions: Use this menu option to access all your recurring income, bills and transfers schedule.

BUG FIXES

- Fixed auto-post (previously known as auto pay) for some users that was not working.

- Fixed notifications not being scheduled for some devices.

I am adding some identity to the app and now it has a name "NEKO" and a new icon that I hope you like.

IMPROVEMENTS

- Recurring transfers: Just as the recurring bills, now you can create recurring transfers to move money between your accounts.

- Undo payment: You can now undo a payment for bills, income, transfers or expenses.

- Income auto-post: You can now set each income individually to be automatically posted on payday.

- Expense in the future: If you enter a expense in the future, it will be scheduled but it won't affect your balance until is posted.

- Upcoming card now shows all the upcoming transactions, including bills, income, transfers and expenses.

- Account summary now includes your upcoming and recent transactions.

- Added "Next month" to the period filter options.

SAFE TO SPEND

- You can now filter the accounts and transaction types you want to include in the calculation.

- When you tap the safe to spend card, it opens a new screen with details on how it was calculated. You can see the breakdown by account as well.

NEW LAYOUT

The app content was reorganized to make it more intuitive and easier to navigate, now it includes the following tabs:

- Overview: See at a glance how much you can spend and what are your upcoming payments.

- Transactions: Visualize your transactions by month on the calendar or list views.

- Accounts: See your accounts categorized by type, for now "Deposit accounts" and "Credit cards"; more to come!

- Insights: I added more helpful charts for you and categorized them by cash flow, spending, income and credit cards. I will be adding more charts soon!

CREDIT CARDS

- New "Auto-Pay" feature that schedules a payment for every month's due date for your credit card.

- Track your credit usage across all your credit cards to help you keep a healthy %

MENU

- Recurring transactions: Use this menu option to access all your recurring income, bills and transfers schedule.

BUG FIXES

- Fixed auto-post (previously known as auto pay) for some users that was not working.

- Fixed notifications not being scheduled for some devices.

6.11.0

Sep 18, 2023

Auto Pay: Now your auto pay bills will automatically be marked as paid on the due date.

6.10.1

Aug 19, 2023

Improved Spanish translation

6.10.0

Aug 13, 2023

Now you can add transactions, transfers and deposits directly from the account summary screen, as well as adding payments and transactions from the credit card summary.

6.9.10

Aug 6, 2023

Some bug fixes and UI improvements

6.9.9

Aug 3, 2023

Fixed a few minor bugs

6.9.8

Jul 30, 2023

Smashed a few bugs and made some performance improvements.

6.9.7

Jul 26, 2023

Smashed a few bugs and made some performance improvements.

6.9.6

Jul 24, 2023

- Now you can add due date reminders for your credit cards.

- New budget friendly option to only remove ads.

- Smashed a few bugs and made some performance improvements.

- New budget friendly option to only remove ads.

- Smashed a few bugs and made some performance improvements.

6.9.4

Jul 5, 2023

- Safe to spend card now shows a breakdown by account. It also remembers your period selection.

- Calendar now shows transactions as well.

- Calendar now shows transactions as well.

6.9.2

Jun 30, 2023

- Improvements for translation to Spanish.

- Fixed a bug that didn't allow to view paid bill details.

- Fixed a bug when entering notes in the recurring bills.

- Fixed a bug that didn't allow to view paid bill details.

- Fixed a bug when entering notes in the recurring bills.

6.9.1

Jun 26, 2023

- NEW! Dark mode and we also made the light mode prettier

- Calendar totals now show the accumulated income and bills, and calculates the remaining expected balance.

- Calendar totals now show the accumulated income and bills, and calculates the remaining expected balance.

6.8.0

May 30, 2023

- NEW! Safe to spend card

Now you can see how much you have left to spend after you pay your bills

- Added more recurring periods

Every 2 months

Every 3 months

Every 6 months

- Fixed some minor bugs, including one with some currency symbols not displaying correctly

Now you can see how much you have left to spend after you pay your bills

- Added more recurring periods

Every 2 months

Every 3 months

Every 6 months

- Fixed some minor bugs, including one with some currency symbols not displaying correctly

6.7.0

May 16, 2023

Added the "Recurring Bills" menu option in the Settings of the app where you can see a summary of your recurring bills by category.

We also did some minor bug fixes and improvements to the app.

Thank you!

We also did some minor bug fixes and improvements to the app.

Thank you!

6.6.0

Apr 29, 2023

New "Every 4 weeks" option for your income schedule.

6.5.0

Apr 24, 2023

Some bug fixes and UI improvements

6.4.0

Mar 30, 2023

NEW FEATURES!

Currency

- Change the currency in the app

Account transfers

- Move money between your accounts

Credit cards

- Use them for bills and transactions

- Track your balance and payments

ENHANCEMENTS

- Filter your bills and transaction easier

More intuitive way to set bill and income recurrence

Currency

- Change the currency in the app

Account transfers

- Move money between your accounts

Credit cards

- Use them for bills and transactions

- Track your balance and payments

ENHANCEMENTS

- Filter your bills and transaction easier

More intuitive way to set bill and income recurrence

Neko: Bills & Spending Tracker FAQ

Click here to learn how to download Neko: Bills & Spending Tracker in restricted country or region.

Check the following list to see the minimum requirements of Neko: Bills & Spending Tracker.

iPhone

Requires iOS 10.0 or later.

iPad

Requires iPadOS 10.0 or later.

iPod touch

Requires iOS 10.0 or later.

Neko: Bills & Spending Tracker supports English

Neko: Bills & Spending Tracker contains in-app purchases. Please check the pricing plan as below:

No ads

$4.99

Premium

$19.99

Premium

$14.99

Premium

$4.99

Premium

$9.99

Premium Lifetime

$49.99

Premium with ads

$7.99