Savings Estimator

$9.99

1.0.1for iPhone, iPad

Age Rating

Savings Estimator Screenshots

About Savings Estimator

The Savings Estimator is designed to help financial services professionals to assist their clients in forecasting and evaluating their retirement needs - before it's too late.

The app consists of three major sections:

1) Surrender Charge Calculator

Use this simple screen to quickly figure out the financial impact of surrendering one insurance policy or annuity for another - what is it going to cost the client, and how much will it take to make them whole again.

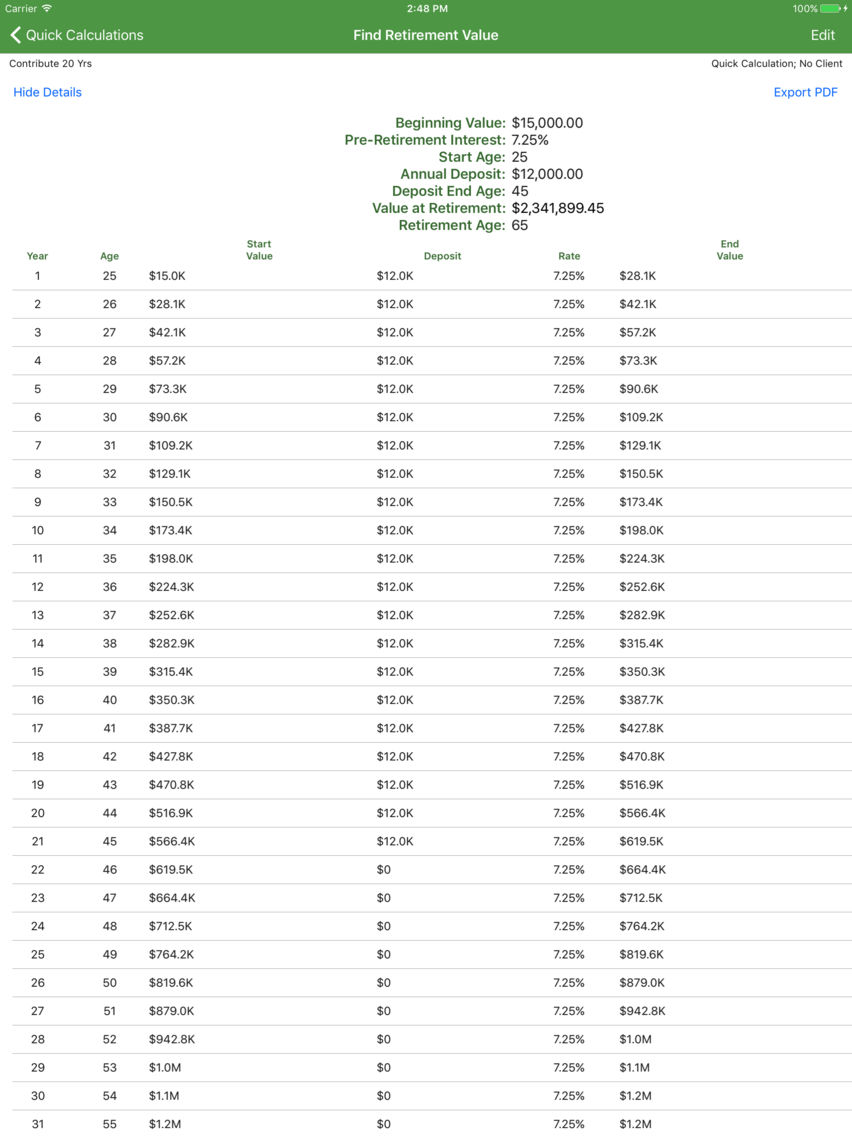

2) Calculation Modeler

The Savings Estimator's main purpose is to help you to simply and clearly explain your clients' financial situation, and lay out for them what steps they'll need to take to attain their goals. To that end, the app supports many different Calculation types; choose the right one for each of your clients. The Calculation types are as follows:

• Starting Value (how much need to have right now)

• Annual Contribution (how much do they need to add to their account each year)

• Retirement Account Value (how much they're on track to have in their account by retirement)

• Retirement Age (at what age will they have enough to retire)

• Ending Account Value (how much will they have in their account at a given point after they retire)

• Ending Age (how long after they retire will it take for their account to draw down to a target level)

• Retirement Income (how much money will they be able to take from their account after they retire)

The last three Calculation types can be modeled either starting from retirement, or beforehand.

Calculations can be modeled with a variety of different options, including:

• Specifying different account yield levels before and after retirement

• Specifying whether or not Requirement Minimum Withdrawals (RMD) are in effect

• Whether withdrawals are in dollars or percentage of remaining balance

• A customized Calculation name, to help you identify it in the list

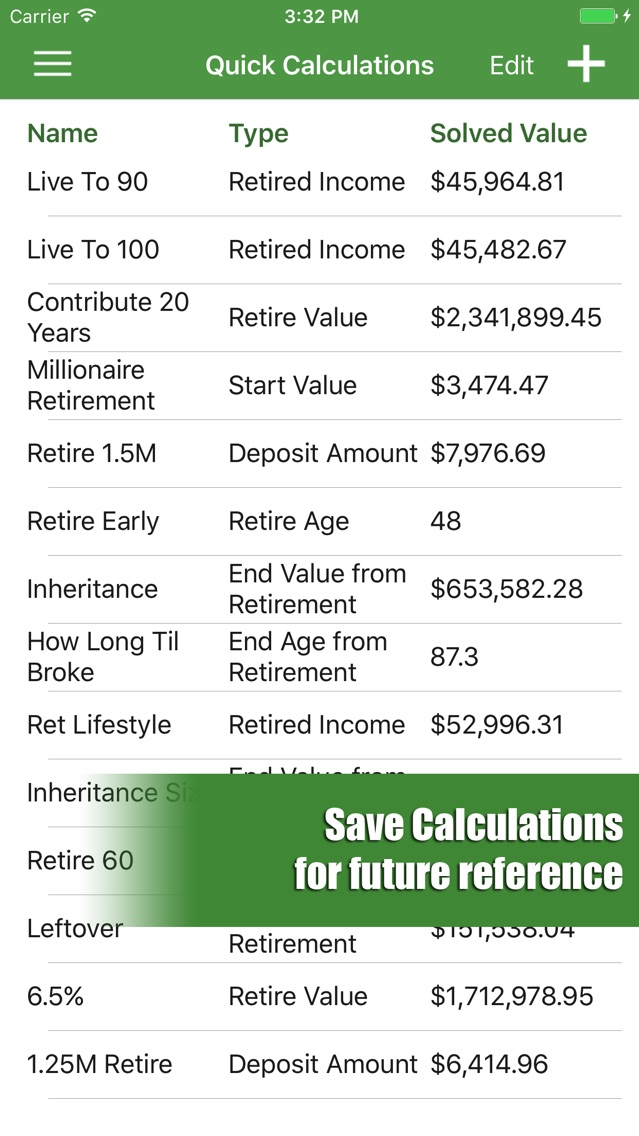

Additionally, once you've created a Calculation, you can save it so you can refer to it again in the future, and with the tap of a button you can produce a professional-looking PDF containing everything about the Calculation, which you can share with your client. You can add your company and/or personal branding to the PDF* so that every Calculation you run will have the crisp, professional look you desire. Additionally, industry-standard disclaimer language is included by default, and you can add your own addenda, as required by your company.

3) Client Tracker*

Keep all the information about your clients in the app, and quickly pull up Calculations that you've run for them. Enter them manually, or import them from your Contacts list, either way it's easy to set up and organize your information.

* Feature requires a paid subscription

Some things to know about the subscription:

• It's called 'Clients and PDF Customization'

• It's an annual subscription and costs $9.99USD per year.

• It automatically renews unless auto-renew is turned off at least 24 hours before the end of the current subscription year

• Payment will be charged to your iTunes account at confirmation of purchase

• Your account will be charged for renewal within 24 hours prior to the end of the current subscription year

• You may manage subscriptions, and auto-renewal may be turned off, by going to your device's Account Settings after purchase

• Any unused portion of a free trial period, if offered, will be forfeited when you purchase a subscription, where applicable (note that this subscription has no free trial period)

• Terms of Use are available at http://inadaydevelopment.com/savings-estimator-terms-of-use/

Special thanks to Alex Elrod for her Graphic Design expertise, Greg Rucker for Programming, and Tyler Thome for Programming. This app wouldn't be where it is today without you!

The app consists of three major sections:

1) Surrender Charge Calculator

Use this simple screen to quickly figure out the financial impact of surrendering one insurance policy or annuity for another - what is it going to cost the client, and how much will it take to make them whole again.

2) Calculation Modeler

The Savings Estimator's main purpose is to help you to simply and clearly explain your clients' financial situation, and lay out for them what steps they'll need to take to attain their goals. To that end, the app supports many different Calculation types; choose the right one for each of your clients. The Calculation types are as follows:

• Starting Value (how much need to have right now)

• Annual Contribution (how much do they need to add to their account each year)

• Retirement Account Value (how much they're on track to have in their account by retirement)

• Retirement Age (at what age will they have enough to retire)

• Ending Account Value (how much will they have in their account at a given point after they retire)

• Ending Age (how long after they retire will it take for their account to draw down to a target level)

• Retirement Income (how much money will they be able to take from their account after they retire)

The last three Calculation types can be modeled either starting from retirement, or beforehand.

Calculations can be modeled with a variety of different options, including:

• Specifying different account yield levels before and after retirement

• Specifying whether or not Requirement Minimum Withdrawals (RMD) are in effect

• Whether withdrawals are in dollars or percentage of remaining balance

• A customized Calculation name, to help you identify it in the list

Additionally, once you've created a Calculation, you can save it so you can refer to it again in the future, and with the tap of a button you can produce a professional-looking PDF containing everything about the Calculation, which you can share with your client. You can add your company and/or personal branding to the PDF* so that every Calculation you run will have the crisp, professional look you desire. Additionally, industry-standard disclaimer language is included by default, and you can add your own addenda, as required by your company.

3) Client Tracker*

Keep all the information about your clients in the app, and quickly pull up Calculations that you've run for them. Enter them manually, or import them from your Contacts list, either way it's easy to set up and organize your information.

* Feature requires a paid subscription

Some things to know about the subscription:

• It's called 'Clients and PDF Customization'

• It's an annual subscription and costs $9.99USD per year.

• It automatically renews unless auto-renew is turned off at least 24 hours before the end of the current subscription year

• Payment will be charged to your iTunes account at confirmation of purchase

• Your account will be charged for renewal within 24 hours prior to the end of the current subscription year

• You may manage subscriptions, and auto-renewal may be turned off, by going to your device's Account Settings after purchase

• Any unused portion of a free trial period, if offered, will be forfeited when you purchase a subscription, where applicable (note that this subscription has no free trial period)

• Terms of Use are available at http://inadaydevelopment.com/savings-estimator-terms-of-use/

Special thanks to Alex Elrod for her Graphic Design expertise, Greg Rucker for Programming, and Tyler Thome for Programming. This app wouldn't be where it is today without you!

Show More

What's New in the Latest Version 1.0.1

Last updated on Jul 21, 2017

Old Versions

Fixed a problem that was preventing previously-purchased Subscriptions from being restored properly.

Show More

Version History

1.0.1

Jul 7, 2017

Fixed a problem that was preventing previously-purchased Subscriptions from being restored properly.

Savings Estimator FAQ

Click here to learn how to download Savings Estimator in restricted country or region.

Check the following list to see the minimum requirements of Savings Estimator.

iPhone

iPad

Savings Estimator supports English