Company Valuation Calculator

USD 1.99

1.9for iPhone, iPad and more

Age Rating

لقطات الشاشة لـ Company Valuation Calculator

About Company Valuation Calculator

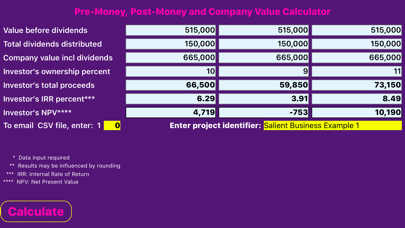

An educational experience for sophisticated users, CoValue, the Company Valuation Calculator, compares an investor's equity infusion, ownership demands and pre-money capital stock purchase offers to company counter offers. Employing an exit-year strategy, financial data, such as Earnings before interest, taxes, depreciation and amortization (EBITDA), is extended by the generally recognized multiple of earnings method to arrive at an exit year enterprise value for the company. Enterprise value is then adjusted for dividends received over the investment period, assets not included in the exit year transaction (such as investments) and current and long term liabilities that must be satisfied upon exit, to arrive at adjusted net proceeds. The investor's internal rate of return (irr) is then calculated by comparing the net proceeds available upon exit to the original investment. The investor's net present value is also calculated to determine investment feasibility based upon the investor's cost of capital.

The Company Valuation Calculator also provides a quick and easy method to perform sensitivity analyses for various levels of investments and ownership percentages. A comma separated value (.csv) file can be emailed from the app for reference and to perform additional spreadsheet analysis.

The Company Valuation Calculator also provides a quick and easy method to perform sensitivity analyses for various levels of investments and ownership percentages. A comma separated value (.csv) file can be emailed from the app for reference and to perform additional spreadsheet analysis.

Show More

تحديث لأحدث إصدار 1.9

Last updated on 10/08/2021

الإصدارات القديمة

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

Show More

Version History

1.9

10/08/2021

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

1.8

04/08/2021

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

1.7

09/01/2020

IMPROVEMENTS

UI Tweaks

FIXED

Various bug fixes and performance improvements

UI Tweaks

FIXED

Various bug fixes and performance improvements

1.6

17/09/2019

Minor bug fixes and performance improvements

1.5

11/09/2019

Bug fixes and performance improvements.

1.4

18/12/2018

Minor bug fix.

1.3

02/02/2018

Minor bug fixes

1.2

08/12/2017

The Company Valuation Calculator was updated to generate a comma separated value (.csv) file of the financial project that can be emailed from the app for reference and to perform additional spreadsheet calculations.

1.1

30/11/2017

Added investor's net present value calculation.

1.0

11/11/2017

Company Valuation Calculator FAQ

انقر هنا لمعرفة كيفية تنزيل Company Valuation Calculator في بلد أو منطقة محظورة.

تحقق من القائمة التالية لمعرفة الحد الأدنى من المتطلبات Company Valuation Calculator.

iPhone

Requiere iOS 13.4 o posterior.

iPad

Requiere iPadOS 13.4 o posterior.

iPod touch

Requiere iOS 13.4 o posterior.

Company Valuation Calculator هي مدعومة على اللغات Inglés