Debt Payoff Planner & Tracker

Debt Free Snowball Calculator

GrátisOffers In-App Purchases

2.2.0for iPhone, iPad and more

Age Rating

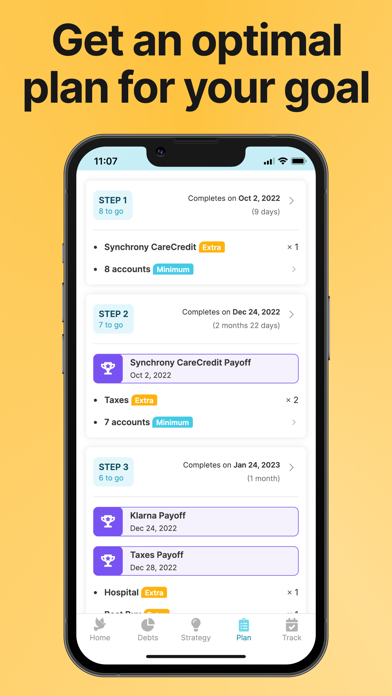

Debt Payoff Planner & Tracker Capturas de tela

About Debt Payoff Planner & Tracker

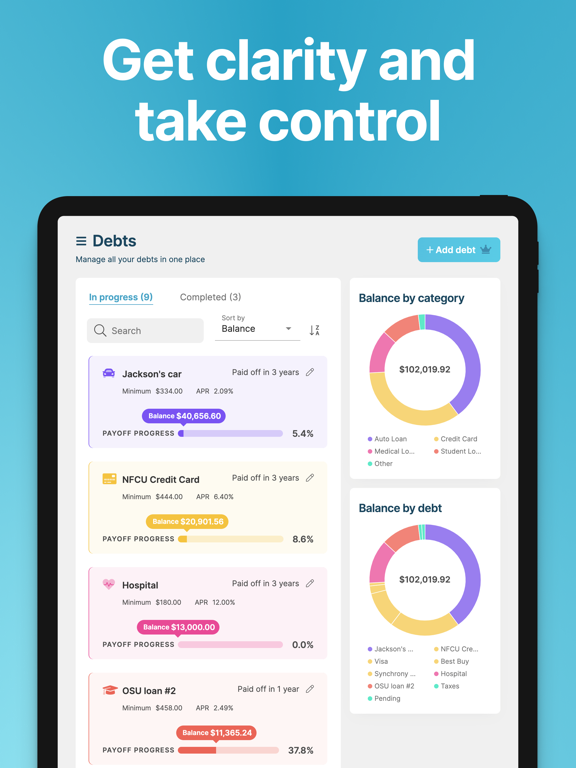

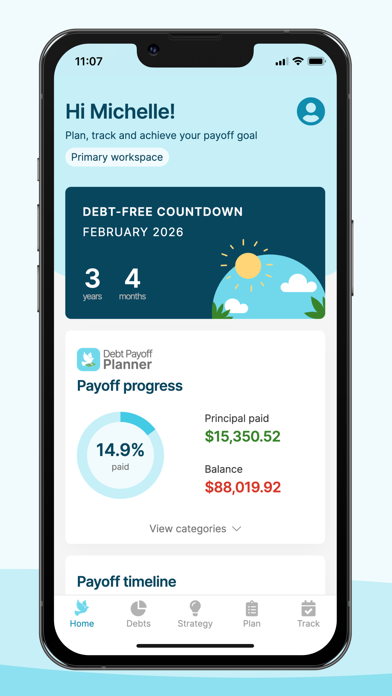

The Debt Payoff Planner app is the simplest way to stop feeling overwhelmed and start having a specific, step-by-step plan for paying off your loans.

Today is the day to make a plan with a loan calculator and beginning paying down debt. Required inputs for calculating your debt free date are the current balance of the loan, the annual percentage rate (APR), and the minimum payment amount. That's the only requirement to getting a customized debt repayment schedule.

Easy steps to becoming debt free:

- Enter your loans and debts

- Enter your additional monthly payment budget to pay down faster

- Choose a debt payoff strategy

* Dave Ramsey's Debt Snowball (lowest balance first)

* Debt Avalanche (highest rate first)

* Debt Snowflake (one-time extra payment toward loans)

* Custom debt free payoff plan

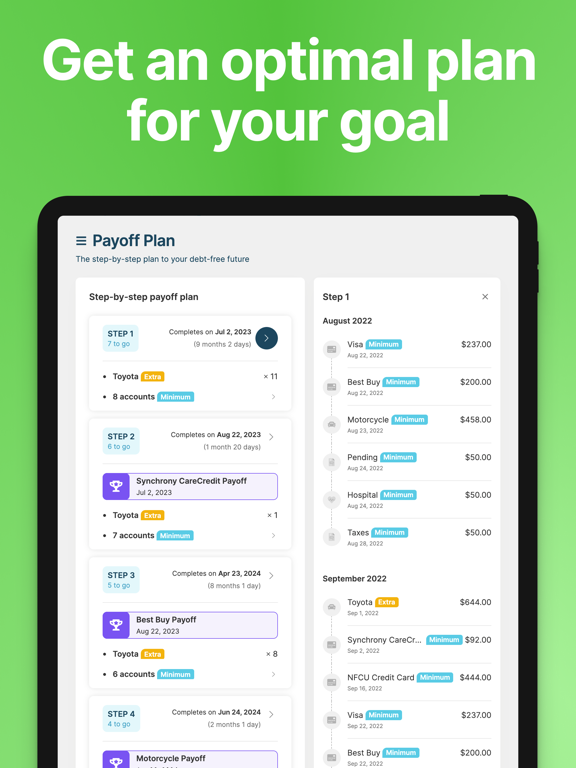

Debt Payoff Planner and Loan Calculator determines the optimum payment plan and how long it will take until you will be debt free. You tell the app how much you want to budget toward paying off your debt and we'll tell you how. We recommend the Debt Snowball strategy because we believe that paying off individual accounts faster will help you stay focused on your financial goal of debt elimination. A payoff plan is only useful if you stick with it!

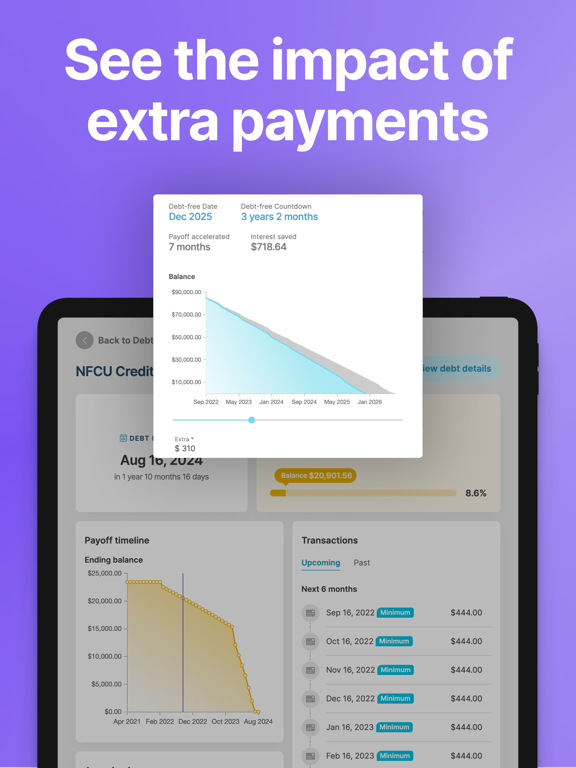

Your ability and willingness to pay more than the minimum payments is how you will become debt free in less time than you imagined. Budgeting your income will help you to get a regular monthly amount to pay down the debt faster. The payoff chart will show two payoff scenarios: only paying the minimum amounts, and the repayment schedule when you pay more the the minimum ever month.

Creating an account enables you to have a secure backup and your information is immediately available if you start using a new device. Getting out of debt is hard, so we try to allow you to take baby steps toward this goal.

We believe that becoming debt free requires an easy starting point and making sure every dollar is leveraged perfectly. The loan calculator has minimal inputs in order to make your money management easy to follow.

The Debt Payoff Planner and Calculator is also used for tracking payments and updating the time-frame for becoming debt-free. Inputting payment information is as simple as typing in the amount and the date the payment was made. The goal of payment tracking is to see your progress over time and affirm that you are staying focused on your financial goals.

In addition to being a debt tracker and loan calculator, we are also trying to help point out some possible next steps with articles focused on how to pay off student loans, auto loans, and credit cards faster. Also, there is some tips on credit card balance transfers as well as strategies for debt consolidation.

We support eight loan categories:

* Credit Cards like Capital One, Citicard, Chase, etc.

* Student Loans like Navient, Sallie Mae, Great Lakes, etc.

* Auto/Car Loans

* Medical Loans

* Mortgages like Rocket Mortgage, SoFi, etc.

* Personal Loans to friends and family or other individuals

* Taxes like IRS or local municipalities

* Other category could be anything from a paycheck loan to a hard money loan

In addition to the Debt Snowball calculator and the Debt Avalanche method, many users like to do a custom sorting of their debts. This customization is available for users that want to be their own debt manager.

We allow the ability to provide a Debt Snowflake payoff as well. A Debt Snowflake is a one-time payment from things like a bonus at work, a tax refund, an extra payday, etc. This additional capability allows you to have tighter control over every dollar you are budgeting.

Terms of Service: https://www.debtpayoffplanner.com/terms-of-service/

Privacy Policy: https://www.debtpayoffplanner.com/privacy-policy/

End-User License Agreement: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

Today is the day to make a plan with a loan calculator and beginning paying down debt. Required inputs for calculating your debt free date are the current balance of the loan, the annual percentage rate (APR), and the minimum payment amount. That's the only requirement to getting a customized debt repayment schedule.

Easy steps to becoming debt free:

- Enter your loans and debts

- Enter your additional monthly payment budget to pay down faster

- Choose a debt payoff strategy

* Dave Ramsey's Debt Snowball (lowest balance first)

* Debt Avalanche (highest rate first)

* Debt Snowflake (one-time extra payment toward loans)

* Custom debt free payoff plan

Debt Payoff Planner and Loan Calculator determines the optimum payment plan and how long it will take until you will be debt free. You tell the app how much you want to budget toward paying off your debt and we'll tell you how. We recommend the Debt Snowball strategy because we believe that paying off individual accounts faster will help you stay focused on your financial goal of debt elimination. A payoff plan is only useful if you stick with it!

Your ability and willingness to pay more than the minimum payments is how you will become debt free in less time than you imagined. Budgeting your income will help you to get a regular monthly amount to pay down the debt faster. The payoff chart will show two payoff scenarios: only paying the minimum amounts, and the repayment schedule when you pay more the the minimum ever month.

Creating an account enables you to have a secure backup and your information is immediately available if you start using a new device. Getting out of debt is hard, so we try to allow you to take baby steps toward this goal.

We believe that becoming debt free requires an easy starting point and making sure every dollar is leveraged perfectly. The loan calculator has minimal inputs in order to make your money management easy to follow.

The Debt Payoff Planner and Calculator is also used for tracking payments and updating the time-frame for becoming debt-free. Inputting payment information is as simple as typing in the amount and the date the payment was made. The goal of payment tracking is to see your progress over time and affirm that you are staying focused on your financial goals.

In addition to being a debt tracker and loan calculator, we are also trying to help point out some possible next steps with articles focused on how to pay off student loans, auto loans, and credit cards faster. Also, there is some tips on credit card balance transfers as well as strategies for debt consolidation.

We support eight loan categories:

* Credit Cards like Capital One, Citicard, Chase, etc.

* Student Loans like Navient, Sallie Mae, Great Lakes, etc.

* Auto/Car Loans

* Medical Loans

* Mortgages like Rocket Mortgage, SoFi, etc.

* Personal Loans to friends and family or other individuals

* Taxes like IRS or local municipalities

* Other category could be anything from a paycheck loan to a hard money loan

In addition to the Debt Snowball calculator and the Debt Avalanche method, many users like to do a custom sorting of their debts. This customization is available for users that want to be their own debt manager.

We allow the ability to provide a Debt Snowflake payoff as well. A Debt Snowflake is a one-time payment from things like a bonus at work, a tax refund, an extra payday, etc. This additional capability allows you to have tighter control over every dollar you are budgeting.

Terms of Service: https://www.debtpayoffplanner.com/terms-of-service/

Privacy Policy: https://www.debtpayoffplanner.com/privacy-policy/

End-User License Agreement: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

Show More

Novidades da Última Versão 2.2.0

Last updated on Dec 29, 2023

Versões Antigas

Additional stability improvements to make you successful on your debt payoff journey

Show More

Version History

2.2.0

Dec 29, 2023

Additional stability improvements to make you successful on your debt payoff journey

2.1.9

Nov 22, 2023

Stability improvements to help you on your debt-free journey!

2.1.5

Dec 7, 2022

New minimum and extra chart to better visualize your journey to become debt-free

2.1.4

Oct 3, 2022

Improvements to the interface and optimization for tablet

2.1.3

Aug 11, 2022

Minor improvements in media handling

2.1.2

Aug 4, 2022

Support for in-app purchases

2.1.0

Aug 4, 2022

Support for in-app purchases

2.0.9

Mar 11, 2022

Improved messaging for connectivity issues

2.0.7

Jan 27, 2022

Optimized for iOS 15, minor bug fixes

2.0.4

Dec 20, 2021

Optimized for iOS 15

2.0.3

Dec 8, 2021

Update for stability and performance

2.0.2

Apr 28, 2021

We've decided to make your debt-free journey more seamless by removing banner ads and interstitial ads for all users. We've also made some small improvements so the Debt Payoff Planner to be a bit faster and more robust. Best of luck on your debt snowball!

1.3.3

Dec 21, 2020

Minor enhancements for security

32

Sep 12, 2020

Improvements for performance and accessibility

30

Aug 28, 2020

Debt-Free Date is now shown alongside Progress by Categories charts so you can quickly view your progress and the date that you'll achieve debt freedom

29

Dec 18, 2019

Minor bug fixes.

1.2.7

Dec 17, 2018

We've fixed the issue where the app would seem to randomly refresh when the phone switches between the wifi and cellular network.

1.2.6

Sep 12, 2018

Minor format changes

1.2.5

Sep 3, 2018

New charts for visualizing all accounts.

Removing refresh events for better performance.

Removing refresh events for better performance.

1.2.4

Aug 7, 2018

Formatting is updated for iPhoneX

Improved performance for computing debt payoff plan

Fixed white screen and connectivity issue

Improved performance for computing debt payoff plan

Fixed white screen and connectivity issue

1.2.2

Dec 30, 2017

- Enhanced network checks to eliminate white screen issues.

- Improved performance

- Minor bug fixes

- FAQ

- Improved performance

- Minor bug fixes

- FAQ

1.1

Feb 11, 2016

This release introduces a debt payoff graph to see the balances going down every month. We've also introduced new debt categories and visualizations for seeing what kinds of loans have the highest balances.

1.0

Nov 4, 2015

Debt Payoff Planner & Tracker FAQ

Debt Payoff Planner & Tracker está disponível fora dos seguintes países restritos:

France

Debt Payoff Planner & Tracker suporta Inglês

Debt Payoff Planner & Tracker contém compras no aplicativo. Verifique o plano de preços abaixo:

1 Month Subscription

R$ 29,90

Friends and Family 12 Months

R$ 199,90

Friends and Family 1 Month

R$ 49,90

3 Month Subscription

R$ 59,90

12 Month Subscription

R$ 129,90

Clique aqui para saber como baixar Debt Payoff Planner & Tracker em um país ou região restrita.

Confira a lista a seguir para ver os requisitos mínimos de Debt Payoff Planner & Tracker.

iPhone

Requer o iOS 13.0 ou posterior.

iPad

Requer o iPadOS 13.0 ou posterior.

iPod touch

Requer o iOS 13.0 ou posterior.