SARS Mobile eFiling

Gratuit

2.0.59(87)for iPhone, iPad and more

3.9

5 Ratings

South African Revenue Service

Developer

102,4 Mo

Size

May 17, 2024

Update Date

Finance

Category

4+

Age Rating

Age Rating

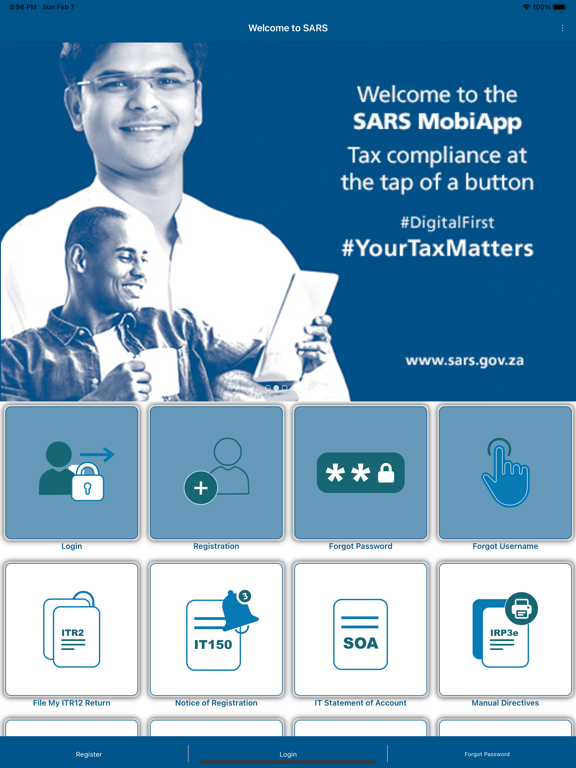

SARS Mobile eFiling Captures d'écran

About SARS Mobile eFiling

Please note that the App is available for IOS version 10 to the latest.

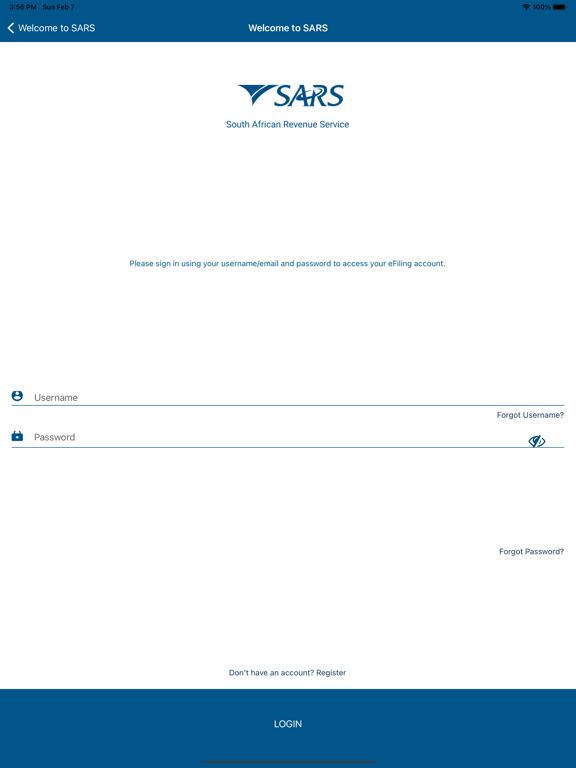

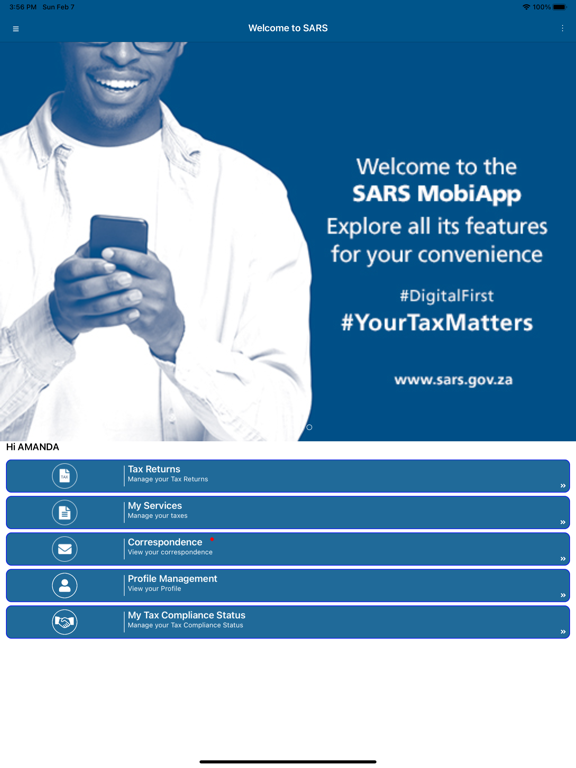

The SARS eFiling App is an innovation from the South African Revenue Service (SARS) that will appeal to the new generation of mobile taxpayers. c, tablets or iPads and receive their assessment. The SARS eFiling App brings simple convenient, easy and secure eFiling to the palm of your hand, anytime, anywhere.

You can use the SARS eFiling App to:

•Register as an eFiler

•Retrieve your username and/or password

•View, complete and submit your annual Income Tax Return (ITR12)

•Use the tax calculator to get an indication of your assessment outcome

•View the status of your return once submitted

•Upload supporting documents

•View a summary of your Notice of Assessment (ITA34)

•Request and view your Statement of Account (ITSA)

•Request Notice of Registration

•View Correspondence

The SARS eFiling App is an innovation from the South African Revenue Service (SARS) that will appeal to the new generation of mobile taxpayers. c, tablets or iPads and receive their assessment. The SARS eFiling App brings simple convenient, easy and secure eFiling to the palm of your hand, anytime, anywhere.

You can use the SARS eFiling App to:

•Register as an eFiler

•Retrieve your username and/or password

•View, complete and submit your annual Income Tax Return (ITR12)

•Use the tax calculator to get an indication of your assessment outcome

•View the status of your return once submitted

•Upload supporting documents

•View a summary of your Notice of Assessment (ITA34)

•Request and view your Statement of Account (ITSA)

•Request Notice of Registration

•View Correspondence

Show More

Quoi de neuf dans la dernière version 2.0.59(87)

Last updated on May 17, 2024

Vieilles Versions

Error handling improvements.

Update to the EFL registration process.

Update to the EFL registration process.

Show More

Version History

2.0.59(87)

Apr 23, 2024

Error handling improvements.

Update to the EFL registration process.

Update to the EFL registration process.

2.0.58(86)

Dec 10, 2023

Improvements on the requesting of an ITR12 return.

Improvement on error handling.

Improvement on error handling.

2.0.57(85)

Aug 11, 2023

New ITR12 HTML5 V2023.00.24.

Benoni Branch Address Update.

Improvements on Error Handling.

Benoni Branch Address Update.

Improvements on Error Handling.

2.0.56(84)

Jul 1, 2023

Improvement on Error handling.

Auto Estimate improvements.

Updated ITR12 form.

Auto Estimate improvements.

Updated ITR12 form.

2.0.55 (83)

Jun 26, 2023

Enhancement on error handling.

Improvements on the downloading of the form.

PIT 2023

Improvements on the downloading of the form.

PIT 2023

2.0.54 (82)

May 19, 2023

New and Improved Tax Compliance Status function.

Improvements on Error Handling.

Improvements on Error Handling.

2.0.44 (71)

Dec 10, 2022

Improvement on Error handling

Introduction of SA Traveller Declaration

2.0.43(70)

Nov 21, 2022

Improvements on error handling

Introduction of LiveChat with a SARS Agent

Introduction of LiveChat with a SARS Agent

2.0.41(68)

Sep 20, 2022

Improvements on error handling.

Renewal of the certificate.

Renewal of the certificate.

2.0.40(67)

Jul 31, 2022

Improvements on error handling.

Update Note on Refund message.

Enhancement to the Auto Estimate process.

Update Note on Refund message.

Enhancement to the Auto Estimate process.

2.0.38(65)

Jul 15, 2022

Improvements on error handling.

Enhancement to the Auto Estimate process.

Enhancement to the Auto Estimate process.

2.0.37(64)

Jul 1, 2022

PIT filing season 2022.

Current Tax year – 2

Auto Estimate Assessments raised by SARS

Request for extension to submit return or supporting documentation

3rd party data refresh

Landing page search function

Remedial action for Tax Compliance Status

Updated message for the Auto Assessment users.

Updated on the Refund status function

Current Tax year – 2

Auto Estimate Assessments raised by SARS

Request for extension to submit return or supporting documentation

3rd party data refresh

Landing page search function

Remedial action for Tax Compliance Status

Updated message for the Auto Assessment users.

Updated on the Refund status function

2.0.32(59)

Feb 18, 2022

Introduction of Current Tax year – 1.

Ability to Accept or upload support documents for Estimated Assessments raised by SARS

Improvements on Error handling

Ability to Accept or upload support documents for Estimated Assessments raised by SARS

Improvements on Error handling

2.0.31 (58)

Dec 10, 2021

Introduction of Debt Management module to SOA, Admin Penalties and ITA34

Improvement on the Tax Directives module

Improvements on Error handling

Improvement on the Tax Directives module

Improvements on Error handling

2.0.27(56)

Oct 15, 2021

Improvements on Error handling

Fixing Petals Maps for Huawei Devices

Fixing the 2FA for Huawei devices.

Fixing Petals Maps for Huawei Devices

Fixing the 2FA for Huawei devices.

2.0.26(55)

Oct 3, 2021

Update to the Profile Security details

Update to the Survey questions

Update to the Survey questions

2.0.25(54)

Sep 4, 2021

Update to the DataPower certificate.

2.0.23(52)

Aug 11, 2021

Fixed internal errors found.

Update to the security contact details

Allow for .africa email address

Update on the Refund status function

Optimization to ensure that the App is faster

Update to the Survey function

Update to the security contact details

Allow for .africa email address

Update on the Refund status function

Optimization to ensure that the App is faster

Update to the Survey function

2.0.21(50)

Jul 10, 2021

PIT 2021 enhancements.

LiveChat enhancements.

Pay Now button redirecting to landing page enhancements.

Dynamically adjusted of landing screen icon labels.

New TCS Request function

Add Facial recognition on the login button on the landing page

Removal of the mandatory Login step when eBooking System.

LiveChat enhancements.

Pay Now button redirecting to landing page enhancements.

Dynamically adjusted of landing screen icon labels.

New TCS Request function

Add Facial recognition on the login button on the landing page

Removal of the mandatory Login step when eBooking System.

2.0.20(48)

Jun 26, 2021

PIT 2021 Filing season changes.

Improvements on internal errors found.

Improvements on internal errors found.

2.0.19(47)

Apr 28, 2021

Improvements on internal errors found.

Improvements on the device’s dark mode functionality.

Improvements on the device’s dark mode functionality.

2.0.18(46)

Feb 13, 2021

Continues improvement of errors

Access to SOQS – Estate Case

Access to SOQS – Request Your Tax Number

Access to SOQS – Submit Supporting Docs

Access to SOQS – Submit Payment Allocation

Access to SOQS – Request to be a Registered Representative

Access to SOQS – Estate Case

Access to SOQS – Request Your Tax Number

Access to SOQS – Submit Supporting Docs

Access to SOQS – Submit Payment Allocation

Access to SOQS – Request to be a Registered Representative

2.0.15(43)

Dec 5, 2020

Continues improvement of errors

PIT Return status – In Progress while busy with Processing

Update on the registration process

Updated schemas for PIT Tax calculations

PIT Return status – In Progress while busy with Processing

Update on the registration process

Updated schemas for PIT Tax calculations

2.0.14(42)

Nov 6, 2020

PIT Refund Status function

Internal improvements of errors

Internal improvements of errors

2.0.13(40)

Oct 3, 2020

Refresh function for taxpayers without IRP5

Lwazi – Chatbot enhancement

eLearning videos order update

Lwazi – Chatbot enhancement

eLearning videos order update

SARS Mobile eFiling FAQ

Cliquez ici pour savoir comment télécharger SARS Mobile eFiling dans un pays ou une région restreints.

Consultez la liste suivante pour voir les exigences minimales de SARS Mobile eFiling.

iPhone

Nécessite iOS 10.0 ou version ultérieure.

iPad

Nécessite iPadOS 10.0 ou version ultérieure.

iPod touch

Nécessite iOS 10.0 ou version ultérieure.