UK Tax Tool 2024

Reversible Salary Calculator

$0.99

15.0for iPhone, iPod touch

Age Rating

UK Tax Tool 2024 スクリーンショット

About UK Tax Tool 2024

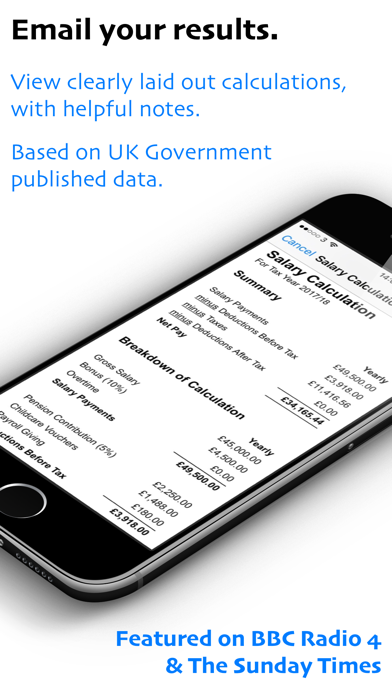

Reached No.1 in UK Finance Charts on the App Store. Also featured on BBC Radio 4 & Sunday Times.

Unlike some free tax calculator apps, Tax Tool has all calculations and data built-in, so there's no need for an internet connection - use it anytime and anywhere, even if you don't have a signal!

SPECIAL FEATURES

• Perform Reverse Salary Calculations for working out your target salary from the take-home pay you need - useful for job interviews and pay rise negotiations

• View a pocket guide of key UK tax rates, limits and allowances, including Income Tax, National Insurance, Capital Gains Tax, Stamp Duty Land Tax and Pension Schemes

• Email your results, including a breakdown of the calculation, for sharing or backup purposes

CUSTOMER REVIEWS

"There's a reason for the high review scores posted for this app...it is an extremely well designed and thought out app."

"Brilliant app. Just saved me £160. Email and print give a very clear printed breakdown."

"This app is easy to use...I rarely write app reviews, but this one deserves all the praise it gets..."

"Outstanding - one of the best personal finance apps available."

OVERVIEW

Tax Tool is designed for UK taxpayers in paid employment, using the Pay-As-You-Earn (PAYE) system of automatic tax deduction.

The app was inspired by the quality of Apple's own apps. It was designed to be comprehensive, but also to be very easy to use and input information, with immediate results.

Choose to enter as much or as little as you want: accuracy is improved if you enter more information and if you enter your Tax Code, but it still gives a useful rough guide if you enter none of these.

A key feature is that it can perform reverse salary calculations. You can enter your desired take-home pay (what you need to receive, after payroll taxes are deducted, to cover your everyday lifestyle) and Tax Tool will instantly work out the salary needed to achieve that target. You can easily flip between these to work out net pay from gross salary or vice-versa.

The app also performs UK VAT calculations, and contains a handy reference for UK tax rates, limits and allowances.

Quick and simple: this is not designed to be a replacement for a full tax return (it doesn’t ask for full details on all your financial affairs), but it does provide a quick and useful estimate of the amount you will receive in your pay packet as an employee.

ADDITIONAL FEATURES

• Instant calculations as you type

• Doesn't need an Internet connection

• Shows a detailed breakdown of the calculations, including Income Tax paid at each band

• Flexible periods: enter and view results annually, monthly, four weekly, fortnightly, weekly, daily or hourly

• Calculates your National Insurance contributions, as well as your employer's

• Includes a VAT calculator, with Reverse function

• Calculates PAYE tax for tax years 2024/25, 2023/24, all the way back to 2009/10

• Provides an instant rough guide. Enter optional settings to improve accuracy

• Works with iOS 16 & iOS 17.

Optional Settings available:

• Scottish tax (SRIT) - all extra bands from 2018 onwards

• Tax Codes - recognises L, M, N, K, T, P, X, Y, BR, D0, D1, NT, 0T, M1 and W1 codes, plus Scottish S and Welsh C versions

• Contributions to company pensions (as a percentage or fixed amount). Also supports salary sacrifice pensions and contributions taken from net pay

• Childcare Vouchers

• Student Loan repayments (Plan 1 and Plan 2 schemes supported)

• Overtime and Bonuses (basic support for percentage or fixed annual amounts)

• Tax deductions

• Benefits-in-kind

• Contributions to charities

• Salary sacrifice (three types)

• Regular deductions from net pay

• Marriage Allowance transfers

• High Income Child Benefit Charge estimation

• Ability to switch off National Insurance calculations if State Pension Age reached.

Unlike some free tax calculator apps, Tax Tool has all calculations and data built-in, so there's no need for an internet connection - use it anytime and anywhere, even if you don't have a signal!

SPECIAL FEATURES

• Perform Reverse Salary Calculations for working out your target salary from the take-home pay you need - useful for job interviews and pay rise negotiations

• View a pocket guide of key UK tax rates, limits and allowances, including Income Tax, National Insurance, Capital Gains Tax, Stamp Duty Land Tax and Pension Schemes

• Email your results, including a breakdown of the calculation, for sharing or backup purposes

CUSTOMER REVIEWS

"There's a reason for the high review scores posted for this app...it is an extremely well designed and thought out app."

"Brilliant app. Just saved me £160. Email and print give a very clear printed breakdown."

"This app is easy to use...I rarely write app reviews, but this one deserves all the praise it gets..."

"Outstanding - one of the best personal finance apps available."

OVERVIEW

Tax Tool is designed for UK taxpayers in paid employment, using the Pay-As-You-Earn (PAYE) system of automatic tax deduction.

The app was inspired by the quality of Apple's own apps. It was designed to be comprehensive, but also to be very easy to use and input information, with immediate results.

Choose to enter as much or as little as you want: accuracy is improved if you enter more information and if you enter your Tax Code, but it still gives a useful rough guide if you enter none of these.

A key feature is that it can perform reverse salary calculations. You can enter your desired take-home pay (what you need to receive, after payroll taxes are deducted, to cover your everyday lifestyle) and Tax Tool will instantly work out the salary needed to achieve that target. You can easily flip between these to work out net pay from gross salary or vice-versa.

The app also performs UK VAT calculations, and contains a handy reference for UK tax rates, limits and allowances.

Quick and simple: this is not designed to be a replacement for a full tax return (it doesn’t ask for full details on all your financial affairs), but it does provide a quick and useful estimate of the amount you will receive in your pay packet as an employee.

ADDITIONAL FEATURES

• Instant calculations as you type

• Doesn't need an Internet connection

• Shows a detailed breakdown of the calculations, including Income Tax paid at each band

• Flexible periods: enter and view results annually, monthly, four weekly, fortnightly, weekly, daily or hourly

• Calculates your National Insurance contributions, as well as your employer's

• Includes a VAT calculator, with Reverse function

• Calculates PAYE tax for tax years 2024/25, 2023/24, all the way back to 2009/10

• Provides an instant rough guide. Enter optional settings to improve accuracy

• Works with iOS 16 & iOS 17.

Optional Settings available:

• Scottish tax (SRIT) - all extra bands from 2018 onwards

• Tax Codes - recognises L, M, N, K, T, P, X, Y, BR, D0, D1, NT, 0T, M1 and W1 codes, plus Scottish S and Welsh C versions

• Contributions to company pensions (as a percentage or fixed amount). Also supports salary sacrifice pensions and contributions taken from net pay

• Childcare Vouchers

• Student Loan repayments (Plan 1 and Plan 2 schemes supported)

• Overtime and Bonuses (basic support for percentage or fixed annual amounts)

• Tax deductions

• Benefits-in-kind

• Contributions to charities

• Salary sacrifice (three types)

• Regular deductions from net pay

• Marriage Allowance transfers

• High Income Child Benefit Charge estimation

• Ability to switch off National Insurance calculations if State Pension Age reached.

Show More

最新バージョン 15.0 の更新情報

Last updated on 2024年03月19日

旧バージョン

Updated for the new 2024/25 tax year, using the very latest information from the March 2024 Budget.

For Scottish taxpayers, the new "Additional Rate" tax band was added for 2024/25.

For Scottish taxpayers, the new "Additional Rate" tax band was added for 2024/25.

Show More

Version History

15.0

2024年03月19日

Updated for the new 2024/25 tax year, using the very latest information from the March 2024 Budget.

For Scottish taxpayers, the new "Additional Rate" tax band was added for 2024/25.

For Scottish taxpayers, the new "Additional Rate" tax band was added for 2024/25.

14.2

2024年01月06日

Updated for the mid-year change announced by the Chancellor of the Exchequer on 22nd November 2023: the decrease in the 12% Employee's National Insurance Contributions band to 10%, effective from 6th January 2024.

14.1.1

2023年07月27日

Added a requested feature: the VAT Calculator now shows the VAT amount on the screen as well as the price before and after VAT.

14.1

2023年07月26日

Added a requested feature: VAT Calculator now shows the VAT amount on the screen as well as the price before and after VAT.

14.0

2023年03月22日

Updated for the new 2023/24 tax year, based on the latest announcements in the Spring Budget on 15th March 2023.

13.4

2022年10月31日

Updated to handle the cancellation of the 1.25% of the National Insurance rate rise from 6th November 2022 onwards. This is in addition to the threshold increase on 6th July 2022.

Please note that in this 22/23 tax year, the yearly amount shown for National Insurance will be more than 52x the weekly amounts shown. This is because the yearly amount shown reflects the higher National Insurance paid in the tax year to 5th July (due to the National Insurance 0% threshold being lower during that period) and the higher National Insurance paid in the tax year to 5th November (due to the rate being 1.25% higher during that period). If you wish to work out the annual amounts for the next 12 months ahead, just multiply the monthly amounts by 12.

Please note that in this 22/23 tax year, the yearly amount shown for National Insurance will be more than 52x the weekly amounts shown. This is because the yearly amount shown reflects the higher National Insurance paid in the tax year to 5th July (due to the National Insurance 0% threshold being lower during that period) and the higher National Insurance paid in the tax year to 5th November (due to the rate being 1.25% higher during that period). If you wish to work out the annual amounts for the next 12 months ahead, just multiply the monthly amounts by 12.

13.3

2022年09月30日

Updated with the new Stamp Duty Land Tax thresholds effective from 23rd September 2022.

Updated to handle the Dynamic Island on the new iPhone 14 Pro & iPhone 14 Pro Max.

Please note that the yearly total of National Insurance paid will be more than 52x the weekly amounts shown (which are based on the new threshold from 6th July). The yearly amounts reflect the higher National Insurance paid in the first 13 weeks of the tax year. There may be further changes to National Insurance on 6th November; if this happens, the app will be updated nearer the time.

Updated to handle the Dynamic Island on the new iPhone 14 Pro & iPhone 14 Pro Max.

Please note that the yearly total of National Insurance paid will be more than 52x the weekly amounts shown (which are based on the new threshold from 6th July). The yearly amounts reflect the higher National Insurance paid in the first 13 weeks of the tax year. There may be further changes to National Insurance on 6th November; if this happens, the app will be updated nearer the time.

13.2

2022年07月02日

Updated with National Insurance threshold change effective from 6th July 2022.

Please note that the yearly total of National Insurance paid will be more than 52x the weekly amounts shown (which are based on the new threshold from 6th July). The yearly amounts reflect the higher National Insurance paid in the first 13 weeks of the tax year.

Please note that the yearly total of National Insurance paid will be more than 52x the weekly amounts shown (which are based on the new threshold from 6th July). The yearly amounts reflect the higher National Insurance paid in the first 13 weeks of the tax year.

13.0

2022年03月24日

- Updated to calculate tax for 2022/23.

- Added a new table for 2022/23 tax rates and allowances.

- As requested, now shows percentage pension contributions up to two decimal places in the email report.

- Added a new table for 2022/23 tax rates and allowances.

- As requested, now shows percentage pension contributions up to two decimal places in the email report.

12.0.1

2021年03月07日

- Updated to calculate tax for 2021/22.

- Added a new table for 2021/22 tax rates and allowances.

- Added a new table for 2021/22 tax rates and allowances.

12.0

2021年03月05日

- Updated to calculate tax for 2021/22.

- Added a new table for 2021/22 tax rates and allowances.

- Added a new table for 2021/22 tax rates and allowances.

11.1.2

2020年10月14日

- Fixed a crash bug related to blank pension contributions, bonuses or overtime payments.

11.1.1

2020年07月10日

Updated the tax tables to reflect changes to VAT and Stamp Duty following the Chancellor's Summer Statement on 8th July.

11.1

2020年04月02日

March Update:

- Updated with rates and information for 2020/21 following the Budget on 11th March 2020

- Now shows a Scottish Flag in the main screen if you select "Scottish Taxpayer" in the settings

April Update:

- Bug fixes for iOS 13.

- Updated with rates and information for 2020/21 following the Budget on 11th March 2020

- Now shows a Scottish Flag in the main screen if you select "Scottish Taxpayer" in the settings

April Update:

- Bug fixes for iOS 13.

11.0

2020年03月12日

- Updated with rates and information for 2020/21 following the Budget on 11th March 2020

- Now shows a Scottish Flag in the main screen if you select "Scottish Taxpayer" in the settings.

- Now shows a Scottish Flag in the main screen if you select "Scottish Taxpayer" in the settings.

10.0

2019年01月02日

Updated with 2019/20 tax year rates, allowances and information.

9.1.2

2018年02月22日

- Updated with all the new Scottish tax bands and thresholds

- Works for 2017/18 and 2018/19 tax years, and more!

- Works for 2017/18 and 2018/19 tax years, and more!

9.1

2018年02月21日

- Updated with all the new Scottish tax bands and thresholds

- Works for 2017/18 and 2018/19 tax years, and more!

- Works for 2017/18 and 2018/19 tax years, and more!

9.0

2017年12月08日

Tax calculations and tax tables have been updated for 2018/19.

All data based on the announcements in The Budget on 22nd November 2017, and data provided by HM Treasury.

Scottish tax rates for 2018/19 have not yet been confirmed.

All data based on the announcements in The Budget on 22nd November 2017, and data provided by HM Treasury.

Scottish tax rates for 2018/19 have not yet been confirmed.

8.1.2

2017年10月27日

- iOS 11 compatible

- iPhone X compatible

- Previously: updated with calculations and tables for 2017/18.

- iPhone X compatible

- Previously: updated with calculations and tables for 2017/18.

8.1.1

2017年03月18日

- Added Residence Nil-Rate Band to the tax tables. Clarified CGT & SRIT notes.

Earlier updates:

- Updated calculations and tables for 2017/18

- Added support for Scottish income tax (SRIT)

- Added the ability to use Marriage Allowance transfers

- Added new options for calculating percentage pension contributions

- Updated the tax tables to reflect changes announced in the Spring Budget

- Scottish 40% income tax threshold lowered, as legislated in the recent Scottish Budget

Earlier updates:

- Updated calculations and tables for 2017/18

- Added support for Scottish income tax (SRIT)

- Added the ability to use Marriage Allowance transfers

- Added new options for calculating percentage pension contributions

- Updated the tax tables to reflect changes announced in the Spring Budget

- Scottish 40% income tax threshold lowered, as legislated in the recent Scottish Budget

8.1

2017年03月15日

- Minor updates to the tax tables to reflect changes announced in The Budget

- Scottish 40% income tax threshold lowered, as legislated in the recent Scottish Budget

January 2017 update:

- Updated calculations and tables for 2017/18

- Added support for Scottish income tax (SRIT)

- Added the ability to use Marriage Allowance transfers

- Added new options for calculating percentage pension contributions

- Scottish 40% income tax threshold lowered, as legislated in the recent Scottish Budget

January 2017 update:

- Updated calculations and tables for 2017/18

- Added support for Scottish income tax (SRIT)

- Added the ability to use Marriage Allowance transfers

- Added new options for calculating percentage pension contributions

8.0

2017年01月31日

- Updated calculations and tables for 2017/18

- Added support for Scottish income tax (SRIT)

- Added the ability to use Marriage Allowance transfers

- Added new options for calculating percentage pension contributions

- Added support for Scottish income tax (SRIT)

- Added the ability to use Marriage Allowance transfers

- Added new options for calculating percentage pension contributions

7.1

2016年04月01日

• Updated calculations for the new 2016/17 tax year

• Reflected changes announced in the March 2016 Budget

• Added support for the Post-2012 Student Loan scheme

• NEW: Updated Air Passenger Duty Child Age (from March 2016)

• Reflected changes announced in the March 2016 Budget

• Added support for the Post-2012 Student Loan scheme

• NEW: Updated Air Passenger Duty Child Age (from March 2016)

7.0

2016年03月22日

• Updated calculations for the new 2016/17 tax year

• Reflected changes announced in the March 2016 Budget

• Added support for the Post-2012 Student Loan scheme

• Reflected changes announced in the March 2016 Budget

• Added support for the Post-2012 Student Loan scheme

UK Tax Tool 2024 FAQ

UK Tax Tool 2024は、以下の国または地域では利用できません。

Nauru,Sao Tome & Principe,Armenia,Belgium,France,Georgia,Chad,Bulgaria,Cyprus,Iraq,Angola,Germany,Spain,Mexico,Rwanda,Cote Divoire,Gambia,Latvia,Madagascar,Estonia,Mauritania,Morocco,Malawi,Tanzania,Paraguay,Tunisia,Kyrgyzstan,Lithuania,Zambia,Macao,Cape Verde,Bhutan,Czech Republic,Guinea-bissau,Kazakhstan,Thailand,Finland,Fiji,Guyana,Congo, Democratic Republic,Gabon,Croatia,Nepal,El Salvador,Ghana,Mali,Lebanon,Nigeria,Vanuatu,Honduras,Liberia,Palau,Tajikistan,Vietnam,Azerbaijan,Cameroon,Ireland,South Korea,Kuwait,Burkina Faso,Chile,Lao Peoples Democratic Republic,Solomon Islands,Senegal,Suriname,Austria,Libya,Namibia,Panama,Swaziland,Denmark,Ecuador,Guatemala,Peru,Myanmar,Mauritius,Papua New Guinea,Uruguay,Botswana,Maldives,Nicaragua,Cambodia,Portugal,Mozambique,Oman,Micronesia,Hungary,Italy,Mongolia,Turkmenistan,Netherlands,Poland,Tonga,Argentina,Benin,Greece,Slovakia,Congo,Costa Rica,Japan,Slovenia,Philippines,Romania,Bolivia,Colombia,Egypt,Luxembourg,Taiwan,Jordan,Malta,Niger,Sri Lanka,Malaysia,Uzbekistan,Afghanistan,Dominica,Algeria,Sierra Leone,Yemen,Brazil,Indonesia,Sweden

UK Tax Tool 2024は次の言語がサポートされています。 English

ここをクリック!地理的に制限されているアプリのダウンロード方法をご参考ください。

次のリストをチェックして、UK Tax Tool 2024の最低システム要件をご確認ください。

iPhone

Requires iOS 14.0 or later.

iPod touch

Requires iOS 14.0 or later.