Age Rating

MVAR 스크린 샷

About MVAR

Helps you find and test your ideas of what might be "leading indicators" of particular stocks or ETFs. For one day ahead indicators only. Explore "The Machine" of the market, and backtest your ideas forthwith.

For these types of simple models, if a backtest achieves 60%+ directional accuracy over a long period, it is considered fairly good. Our backtests have metrics which check how likely it is to achieve the model's level of accuracy by flipping coins for the same number of backtest days. For example, getting 6 out of 10 correct by flipping coins (60%) is much more likely than getting 60 out of 100 (also 60%) correct by flipping coins. You must look at % correct, and also how long you get this level of accuracy. The run length Plots give an idea if the model is getting better or worse over time.

We don't even report out model Fit quality to avoid confusion, since Forecast quality is usually worse than Fit quality. Hence: Always backtest to estimate Forecast quality.

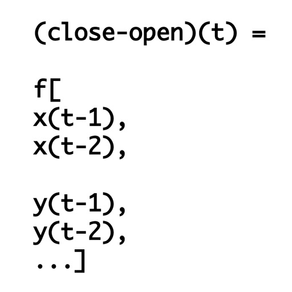

The app models the (close-open) price direction (that is, today's price travel) of a given target stock as a function of prior days opening and closing prices of related stocks. Also works for ETFs if they are available in Google Finance historical data.

Check out our newest features: low-contributor variable weed-out for K-nearest classifier models, to reduce overfitting and possibly improve forecast quality (searching as always for the most parsimonious model, "as simple as possible but no simpler..."), and the use of volatilities as candidate leading indicators.

Some use cases:

- You want to keep a position open for 1 trading day only. Models built with this app can give an estimate as to whether the stock/ETF will go up or down today.

- You want to buy or sell a given stock/ETF for other reasons. Models built with this app can give an estimate whether Today is a good day to buy or sell, or whether you might want to wait until a later day to make a trade.

Some thoughts on backtesting, to assist with judgement calls:

http://www.quantstart.com/articles/Successful-Backtesting-of-Algorithmic-Trading-Strategies-Part-I

From Wikipedia:

"The only prior knowledge required is a list of variables which can be hypothesized to affect each other intertemporally."

http://en.wikipedia.org/wiki/Vector_autoregression

For example, one might think that the price change of General Motors today (GM) might depend on the recent prices of oil (USO is an oil ETF). This can be modeled using a tool such as this.

Note that there may not be a predictive relationship for your chosen symbols. In this case, a model's backtest will be poor (low % correct) and the model is not useful for forecasting.

In the case where a backtest yields reasonable results, the model may have some predictive power for 1 day ahead forecasts.

Only price travel Direction is attempted to be modeled, not the actual price change in dollars.

Quickstart:

1. enter symbol to forecast and candidate predictor symbols.

2. select Backtest or Forecast.

3. Press Run. Calculation results will appear in green window.

Further details at http://diffent.com/MktVecAR.pdf

Features:

Up to 6 candidate predictor stocks/ETFs (including target).

3 model types generated for every forecast for comparison purposes:

annealing classifier (slow or fast)

linear least squares

k-nearest classifier

1 and 2 day data lags automatically generated [AR(2) type models]

Up to 500 trading days of backtests.

1 day forward forecast.

Model can be built/forecasted before market opens since "today's" open prices are not included in the model.

Detailed log file of calculations.

Calculations done on a server for battery conservation.

Ability to Stop long calculations on the server.

Download the assembled regression tables with dates aligned in CSV format for further study.

Send downloaded tables to other apps on your device or via email.

For these types of simple models, if a backtest achieves 60%+ directional accuracy over a long period, it is considered fairly good. Our backtests have metrics which check how likely it is to achieve the model's level of accuracy by flipping coins for the same number of backtest days. For example, getting 6 out of 10 correct by flipping coins (60%) is much more likely than getting 60 out of 100 (also 60%) correct by flipping coins. You must look at % correct, and also how long you get this level of accuracy. The run length Plots give an idea if the model is getting better or worse over time.

We don't even report out model Fit quality to avoid confusion, since Forecast quality is usually worse than Fit quality. Hence: Always backtest to estimate Forecast quality.

The app models the (close-open) price direction (that is, today's price travel) of a given target stock as a function of prior days opening and closing prices of related stocks. Also works for ETFs if they are available in Google Finance historical data.

Check out our newest features: low-contributor variable weed-out for K-nearest classifier models, to reduce overfitting and possibly improve forecast quality (searching as always for the most parsimonious model, "as simple as possible but no simpler..."), and the use of volatilities as candidate leading indicators.

Some use cases:

- You want to keep a position open for 1 trading day only. Models built with this app can give an estimate as to whether the stock/ETF will go up or down today.

- You want to buy or sell a given stock/ETF for other reasons. Models built with this app can give an estimate whether Today is a good day to buy or sell, or whether you might want to wait until a later day to make a trade.

Some thoughts on backtesting, to assist with judgement calls:

http://www.quantstart.com/articles/Successful-Backtesting-of-Algorithmic-Trading-Strategies-Part-I

From Wikipedia:

"The only prior knowledge required is a list of variables which can be hypothesized to affect each other intertemporally."

http://en.wikipedia.org/wiki/Vector_autoregression

For example, one might think that the price change of General Motors today (GM) might depend on the recent prices of oil (USO is an oil ETF). This can be modeled using a tool such as this.

Note that there may not be a predictive relationship for your chosen symbols. In this case, a model's backtest will be poor (low % correct) and the model is not useful for forecasting.

In the case where a backtest yields reasonable results, the model may have some predictive power for 1 day ahead forecasts.

Only price travel Direction is attempted to be modeled, not the actual price change in dollars.

Quickstart:

1. enter symbol to forecast and candidate predictor symbols.

2. select Backtest or Forecast.

3. Press Run. Calculation results will appear in green window.

Further details at http://diffent.com/MktVecAR.pdf

Features:

Up to 6 candidate predictor stocks/ETFs (including target).

3 model types generated for every forecast for comparison purposes:

annealing classifier (slow or fast)

linear least squares

k-nearest classifier

1 and 2 day data lags automatically generated [AR(2) type models]

Up to 500 trading days of backtests.

1 day forward forecast.

Model can be built/forecasted before market opens since "today's" open prices are not included in the model.

Detailed log file of calculations.

Calculations done on a server for battery conservation.

Ability to Stop long calculations on the server.

Download the assembled regression tables with dates aligned in CSV format for further study.

Send downloaded tables to other apps on your device or via email.

Show More

최신 버전 7.4의 새로운 기능

Last updated on Mar 24, 2024

오래된 버전

Add links to related Medium articles.

Show More

Version History

7.4

Mar 24, 2024

Add links to related Medium articles.

MVAR 가격

오늘:

무료

최저 가격:

무료

최고 가격:

₩1,100

MVAR FAQ

제한된 국가 또는 지역에서 MVAR를 다운로드하는 방법을 알아보려면 여기를 클릭하십시오.

MVAR의 최소 요구 사항을 보려면 다음 목록을 확인하십시오.

iPhone

Requires iOS 14.0 or later.

iPad

Requires iPadOS 14.0 or later.

Mac

Requires macOS 11.0 or later.

iPod touch

Requires iOS 14.0 or later.

MVAR은 다음 언어를 지원합니다. English