SGV Tax Calendar

무료

1.0.0for iPhone, iPad and more

Age Rating

SGV Tax Calendar 스크린 샷

About SGV Tax Calendar

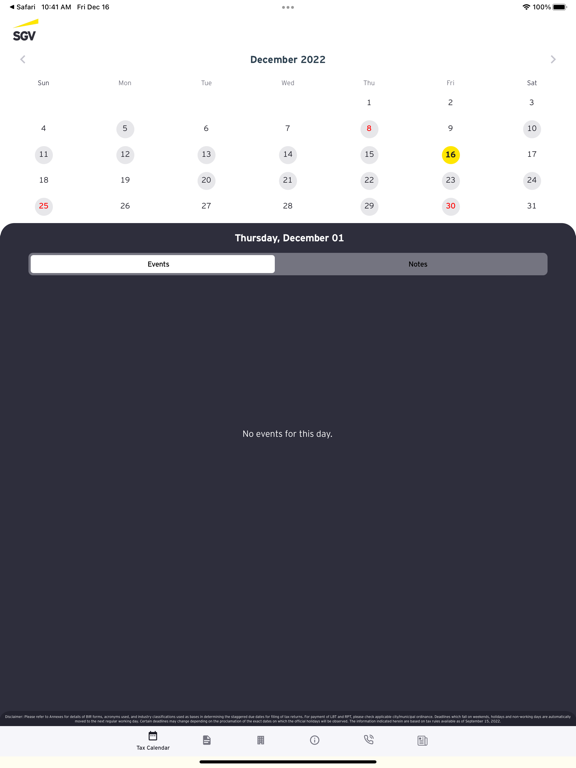

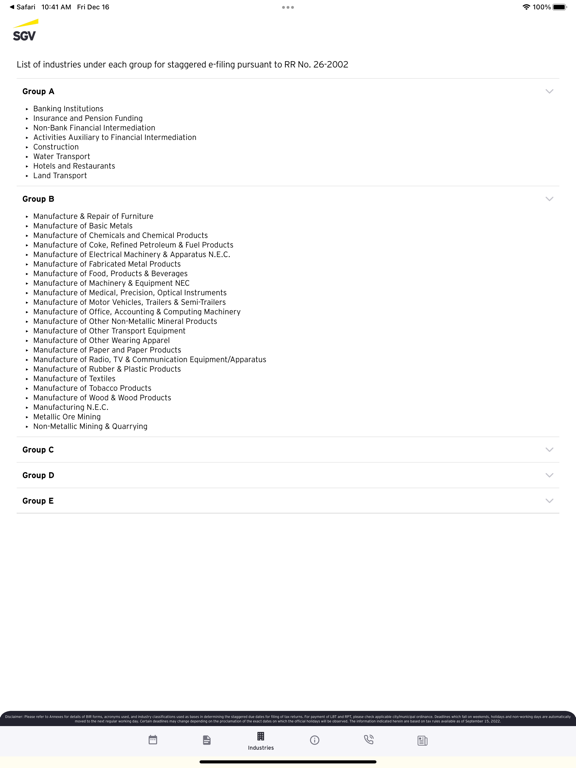

The SGV Tax Calendar app is intended to provide users with a free platform to efficiently keep track of important BIR deadlines, with a flash listing of the tax deadlines falling due on each date in the calendar and user capability to tag tax requirements according to status (e.g., done, pending, N/A) and to add offline notes on each date in the calendar.

With the current global business environment, keeping track of the copious number of BIR deadlines may be a challenging endeavor. However, with this user-friendly SGV Tax Calendar app, you will be able to more easily monitor and remember BIR deadlines. Links to relevant articles and tax bulletins are also accessible to keep you up-to-date on tax rulings, issuances, circulars, opinions and decisions from Philippine government agencies, as well as judicial bodies.

This application is intended for general guidance only and is not intended to be a substitute for detailed research or the exercise of professional judgment. Neither SGV & Co. nor any other member firm of the global EY organization accepts any responsibility for loss occasioned to any person acting or refraining from action as a result of any content in this application. On any specific matter, reference should be made to the appropriate advisor. While the information in this application has been carefully prepared, please note that these are of a general nature only.

Further, only guidelines and tax deadlines of general application are presented in this calendar. Thus, deadlines relevant to excise taxation and all other non-recurring taxable transactions are not provided here. Moreover, the deadlines mentioned herein are pursuant to our understanding of the existing administrative issuances of the relevant tax authorities as of 16 January 2023. These may be subject to change depending on amendments in the laws, regulations, rules, or issuances affecting statutory deadlines and timelines for the submission and payment of taxes.

With the current global business environment, keeping track of the copious number of BIR deadlines may be a challenging endeavor. However, with this user-friendly SGV Tax Calendar app, you will be able to more easily monitor and remember BIR deadlines. Links to relevant articles and tax bulletins are also accessible to keep you up-to-date on tax rulings, issuances, circulars, opinions and decisions from Philippine government agencies, as well as judicial bodies.

This application is intended for general guidance only and is not intended to be a substitute for detailed research or the exercise of professional judgment. Neither SGV & Co. nor any other member firm of the global EY organization accepts any responsibility for loss occasioned to any person acting or refraining from action as a result of any content in this application. On any specific matter, reference should be made to the appropriate advisor. While the information in this application has been carefully prepared, please note that these are of a general nature only.

Further, only guidelines and tax deadlines of general application are presented in this calendar. Thus, deadlines relevant to excise taxation and all other non-recurring taxable transactions are not provided here. Moreover, the deadlines mentioned herein are pursuant to our understanding of the existing administrative issuances of the relevant tax authorities as of 16 January 2023. These may be subject to change depending on amendments in the laws, regulations, rules, or issuances affecting statutory deadlines and timelines for the submission and payment of taxes.

Show More

최신 버전 1.0.0의 새로운 기능

Last updated on Jan 19, 2023

Version History

1.0.0

Jan 17, 2023

SGV Tax Calendar FAQ

제한된 국가 또는 지역에서 SGV Tax Calendar를 다운로드하는 방법을 알아보려면 여기를 클릭하십시오.

SGV Tax Calendar의 최소 요구 사항을 보려면 다음 목록을 확인하십시오.

iPhone

iOS 12.4 이상 필요.

iPad

iPadOS 12.4 이상 필요.

iPod touch

iOS 12.4 이상 필요.

SGV Tax Calendar은 다음 언어를 지원합니다. 영어

![국세청 홈택스 [손택스]](https://image.winudf.com/v2/image1/MjMzODI4NjhfMTcxMjEzMDE3Ml8wODQ/screen-0.png?fakeurl=1&type=png&w=106)