MyNavy Financial Literacy

Free

5.1for iPhone, iPad and more

7.3

17 Ratings

Program Executive Office for Enterprise Information Systems, Sea Warrior Program

Developer

158.5 MB

Size

Aug 29, 2023

Update Date

Reference

Category

4+

Age Rating

Age Rating

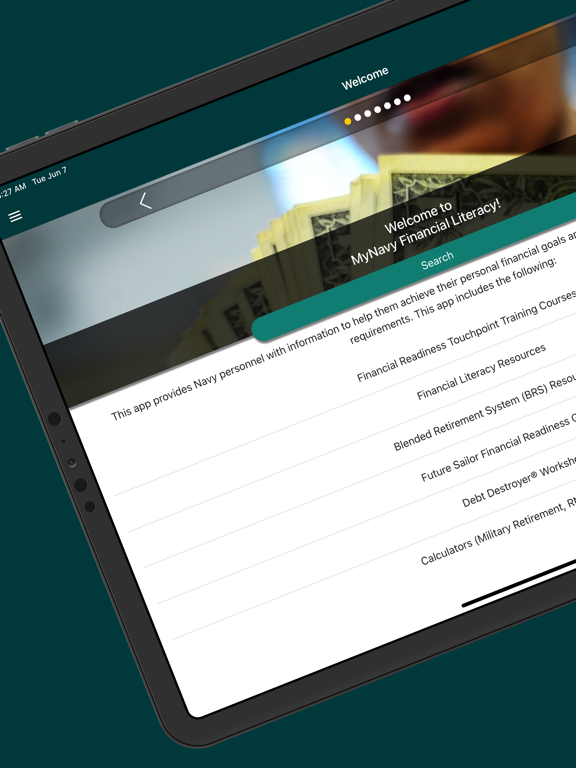

MyNavy Financial Literacy Screenshots

About MyNavy Financial Literacy

Revised for 2022, the MyNavy Financial Literacy application provides Navy personnel with information to help them achieve their personal financial goals and meet the Navy’s financial literacy education requirements. This app allows Service members and their families to access financial literacy resources and training anywhere, anytime via their mobile devices.

The FY16 National Defense Authorization Act (NDAA) made significant changes to the military retirement system and mandated that Navy personnel obtain financial literacy training at personal and professional touchpoints across the military lifecycle. This app supports that training via financial readiness touchpoint courses and a collection of in-app and online resources.

The application is divided into the following sections for ease of use:

-- Financial Readiness Touchpoint Training Courses – offers access to twelve mandatory courses and allows Service members to submit course completion certificates to their Electronic Training Jacket (ETJ).

-- Financial Literacy Resources – includes links to the Military Leader’s Economic Security Toolkit, information on COVID-19 Financial Resources, Banking and Financial Management, Consumer Awareness, Car Buying Basics, Spending Plans, Credit and Debt, Investments and Thrift Savings Plan (TSP), and Insurance.

-- Blended Retirement System (BRS) Resources – offers various types of info, links and videos, and provides information about the Navy Standard Integrated Personnel System (NSIPS), which allows Service members to view their BRS status, verify BRS election, and elect Continuation Pay.

-- Future Sailor Financial Readiness Guide – helps future Sailors financially prepare before leaving for Boot Camp. Provides information on banking and bill payments, life insurance and beneficiaries, education and retirement benefits, and information for military spouses.

-- Debt Destroyer® Workshop – offers proven techniques to overcome high interest rate debt and get on track to a more secure financial future.

-- Calculators – provides a comparison between the High-3 retirement plan and BRS, and estimates a Sailor’s retirement benefits under BRS, High-3, Final Pay and REDUX retirement plans.

The app also includes a Favorites section for bookmarking app pages and an Emergency section with information on a variety of crisis-related topics. The MyNavy Financial Literacy app is also searchable. Download yours today!

The FY16 National Defense Authorization Act (NDAA) made significant changes to the military retirement system and mandated that Navy personnel obtain financial literacy training at personal and professional touchpoints across the military lifecycle. This app supports that training via financial readiness touchpoint courses and a collection of in-app and online resources.

The application is divided into the following sections for ease of use:

-- Financial Readiness Touchpoint Training Courses – offers access to twelve mandatory courses and allows Service members to submit course completion certificates to their Electronic Training Jacket (ETJ).

-- Financial Literacy Resources – includes links to the Military Leader’s Economic Security Toolkit, information on COVID-19 Financial Resources, Banking and Financial Management, Consumer Awareness, Car Buying Basics, Spending Plans, Credit and Debt, Investments and Thrift Savings Plan (TSP), and Insurance.

-- Blended Retirement System (BRS) Resources – offers various types of info, links and videos, and provides information about the Navy Standard Integrated Personnel System (NSIPS), which allows Service members to view their BRS status, verify BRS election, and elect Continuation Pay.

-- Future Sailor Financial Readiness Guide – helps future Sailors financially prepare before leaving for Boot Camp. Provides information on banking and bill payments, life insurance and beneficiaries, education and retirement benefits, and information for military spouses.

-- Debt Destroyer® Workshop – offers proven techniques to overcome high interest rate debt and get on track to a more secure financial future.

-- Calculators – provides a comparison between the High-3 retirement plan and BRS, and estimates a Sailor’s retirement benefits under BRS, High-3, Final Pay and REDUX retirement plans.

The app also includes a Favorites section for bookmarking app pages and an Emergency section with information on a variety of crisis-related topics. The MyNavy Financial Literacy app is also searchable. Download yours today!

Show More

What's New in the Latest Version 5.1

Last updated on Aug 29, 2023

Old Versions

-- Bug fixes and stability updates

Show More

Version History

5.1

Aug 29, 2023

-- Bug fixes and stability updates

5.0

Jun 10, 2022

-- Updated Financial Readiness Touchpoint Training courses

-- New links to the Military Leader’s Economic Security Toolkit, Debt Destroyer® Workshop, and Car Buying Basics

-- New Future Sailor Financial Readiness Guide

-- Calendar Year 2022 and2023 Continuation Pay Rates under BRS

-- Bug fixes

-- New links to the Military Leader’s Economic Security Toolkit, Debt Destroyer® Workshop, and Car Buying Basics

-- New Future Sailor Financial Readiness Guide

-- Calendar Year 2022 and2023 Continuation Pay Rates under BRS

-- Bug fixes

4.0

Dec 17, 2020

Revised and expanded in 2020

-- 12 additional Financial Readiness Touchpoint courses; users can submit course completion certificates to their NTMPS Electronic Training Jacket (ETJ) from the app

-- New links to the MilSpouse Money Mission website, the Million Dollar Sailor (MDS) curriculum and the Thrift Savings Plan (TSP) Growth estimations

-- Calendar Year 2020 Continuation Pay Rates for Blended Retirement System

-- Updated content and links to additional resources, as well as additional content

-- Assistance in finding Personal Financial Managers and Counselors

-- Bug fixes

-- 12 additional Financial Readiness Touchpoint courses; users can submit course completion certificates to their NTMPS Electronic Training Jacket (ETJ) from the app

-- New links to the MilSpouse Money Mission website, the Million Dollar Sailor (MDS) curriculum and the Thrift Savings Plan (TSP) Growth estimations

-- Calendar Year 2020 Continuation Pay Rates for Blended Retirement System

-- Updated content and links to additional resources, as well as additional content

-- Assistance in finding Personal Financial Managers and Counselors

-- Bug fixes

3.0

Aug 26, 2019

-- New links to YouTube videos, retirement calculators, Blended Retirement System (BRS) Lump Sum course and financial topics

-- Calendar Year 2020 Continuation Pay Rates for BRS

-- Streamlined access to MyNavy Career Center Contact Center for 24/7 help

-- Bug fixes

-- Calendar Year 2020 Continuation Pay Rates for BRS

-- Streamlined access to MyNavy Career Center Contact Center for 24/7 help

-- Bug fixes

2.0

Jun 15, 2018

-- Revised and Expanded in 2018

-- Additional training courses with opportunity to receive credit

-- Includes links to external financial calculator

-- Reduced app size by delivering applicable course content

-- Personalized user experience

-- Updated user interface

-- Bug fixes

-- Additional training courses with opportunity to receive credit

-- Includes links to external financial calculator

-- Reduced app size by delivering applicable course content

-- Personalized user experience

-- Updated user interface

-- Bug fixes

1.6.13

Jan 30, 2017

Content updates.

1.6.11

Jan 23, 2017

MyNavy Financial Literacy FAQ

Click here to learn how to download MyNavy Financial Literacy in restricted country or region.

Check the following list to see the minimum requirements of MyNavy Financial Literacy.

iPhone

Requires iOS 8.0 or later.

iPad

Requires iPadOS 8.0 or later.

iPod touch

Requires iOS 8.0 or later.