Salary & Income Tax Manager

$2.99

1.2for iPhone

Age Rating

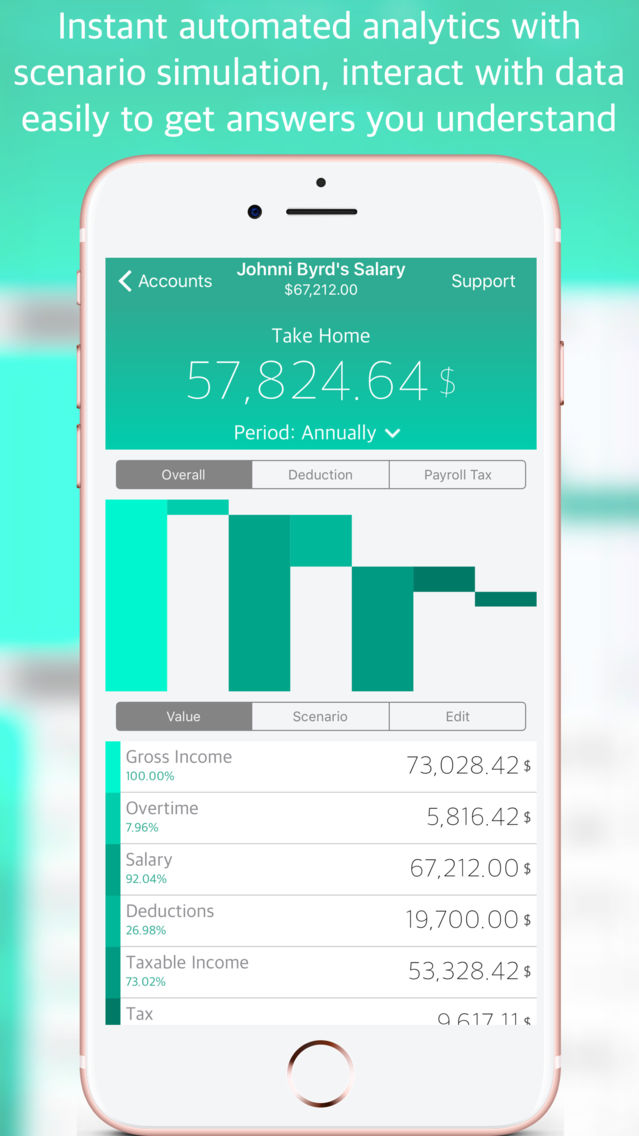

Salary & Income Tax Manager Screenshots

About Salary & Income Tax Manager

Salary Manager is a smart salary and income tax data analysis and visualization you can use to quickly discover patterns and meaning in your salary information - all on your own.

———————————————————

For Business or Personal Uses

———————————————————

With guided data discovery, instant automated predictive analytics and cognitive capabilities such as scenario simulation dialogue, you can interact with data easily to get answers you understand. Whether you need to quickly spot a pattern or you have a team that needs to visualize salary data, Salary Manager has you covered

Surface new patterns you never recognized before and see the factors most likely to influence business/personal decision and the math behind the findings. You’re now ready to act confidently

Reveal deeper insights and provide better visualizations via presentation-ready reports ensuring high accuracy to drive quality decision making

Multiple analysis period: Annually, Monthly, Semi-Monthly, Bi-Weekly, Weekly.

——————

Hassle Free

——————

Add your data easily and instantly get a list of interesting and meaningful stories behind your salary data. Get insights and associations you can understand from your salary data you trust

You only need to fill out salary information. SalaryManager will take care the rest:

- Annual salary or hourly wage (depend on paying type)

- Number of dependents

- Blind or not

- Age 65 or older or not

- Overtime Hours

- Overtime Multiplier: Time and a Half, Double Time, Double Time and a Half, Triple Time, Quadruple Time

- Filling Status (Single, Married Joint, Married Separate, Head Household)

Set default setting for these information to instantly get result without filling salary information over and over again when adding new account. Default setting will be used

——————————

Best User Experience

——————————

- Beautifully crafted user interface

- Dynamic gradient color theme

- Have only 2 screens: 1) List/Setting; 2} Detail to each account

- Instant result to any change.

- Changing scenario on the same screen.

—————————

Attention to Detail

—————————

SalaryManager provides accurate, consistent numbers to the current tax law on specified country ensuring high accuracy to drive high quality critical decision making. SalaryManager support:

- Salary based and wage based

- Gross Income. An individual's total personal income, before accounting for taxes or deductions

- Income from overtime works

- Standard deduction that depend on Filing Status

- Dependent deduction calculated according to how many dependents you have

- Additional standard deduction for elderly or blind taxpayers. The additional standard deduction amount increases if the individual is also unmarried

- Income Tax Brackets. Income tax has 7 brackets. The amount of tax you owe depends on your income level and filing status. Moving into a higher tax bracket does not mean that all of your income will be taxed at a higher rate. Instead, only the money that you earn within a particular bracket is subject to that particular tax rate.

- Personal exemption and Personal Exemption Phaseout (PEP)

- Payroll tax support for social security or old age, survivor and disability insurance (OASDI) and medicare

———————

Privacy Policy

———————

SalaryManager is an online app. That's mean this is 100% private app. Data stored locally using native storage engine on your phone (The same storage for storing your photo/video/file). Check available storage: Go to Settings > General > Storage

——————————

Support

——————————

We provide In-App-Support. Open Side Menu, tap "Support"

———————————————————

For Business or Personal Uses

———————————————————

With guided data discovery, instant automated predictive analytics and cognitive capabilities such as scenario simulation dialogue, you can interact with data easily to get answers you understand. Whether you need to quickly spot a pattern or you have a team that needs to visualize salary data, Salary Manager has you covered

Surface new patterns you never recognized before and see the factors most likely to influence business/personal decision and the math behind the findings. You’re now ready to act confidently

Reveal deeper insights and provide better visualizations via presentation-ready reports ensuring high accuracy to drive quality decision making

Multiple analysis period: Annually, Monthly, Semi-Monthly, Bi-Weekly, Weekly.

——————

Hassle Free

——————

Add your data easily and instantly get a list of interesting and meaningful stories behind your salary data. Get insights and associations you can understand from your salary data you trust

You only need to fill out salary information. SalaryManager will take care the rest:

- Annual salary or hourly wage (depend on paying type)

- Number of dependents

- Blind or not

- Age 65 or older or not

- Overtime Hours

- Overtime Multiplier: Time and a Half, Double Time, Double Time and a Half, Triple Time, Quadruple Time

- Filling Status (Single, Married Joint, Married Separate, Head Household)

Set default setting for these information to instantly get result without filling salary information over and over again when adding new account. Default setting will be used

——————————

Best User Experience

——————————

- Beautifully crafted user interface

- Dynamic gradient color theme

- Have only 2 screens: 1) List/Setting; 2} Detail to each account

- Instant result to any change.

- Changing scenario on the same screen.

—————————

Attention to Detail

—————————

SalaryManager provides accurate, consistent numbers to the current tax law on specified country ensuring high accuracy to drive high quality critical decision making. SalaryManager support:

- Salary based and wage based

- Gross Income. An individual's total personal income, before accounting for taxes or deductions

- Income from overtime works

- Standard deduction that depend on Filing Status

- Dependent deduction calculated according to how many dependents you have

- Additional standard deduction for elderly or blind taxpayers. The additional standard deduction amount increases if the individual is also unmarried

- Income Tax Brackets. Income tax has 7 brackets. The amount of tax you owe depends on your income level and filing status. Moving into a higher tax bracket does not mean that all of your income will be taxed at a higher rate. Instead, only the money that you earn within a particular bracket is subject to that particular tax rate.

- Personal exemption and Personal Exemption Phaseout (PEP)

- Payroll tax support for social security or old age, survivor and disability insurance (OASDI) and medicare

———————

Privacy Policy

———————

SalaryManager is an online app. That's mean this is 100% private app. Data stored locally using native storage engine on your phone (The same storage for storing your photo/video/file). Check available storage: Go to Settings > General > Storage

——————————

Support

——————————

We provide In-App-Support. Open Side Menu, tap "Support"

Show More

What's New in the Latest Version 1.2

Last updated on Feb 9, 2019

Old Versions

Fix wrong calculation

Show More

Version History

1.2

Dec 2, 2016

Fix wrong calculation

Salary & Income Tax Manager FAQ

Click here to learn how to download Salary & Income Tax Manager in restricted country or region.

Check the following list to see the minimum requirements of Salary & Income Tax Manager.

iPhone

Salary & Income Tax Manager supports English