E-File Tax Extension Form 8868

Nonprofit Tax Extension

Free

1.2.1for iPad

Age Rating

لقطات الشاشة لـ E-File Tax Extension Form 8868

About E-File Tax Extension Form 8868

Securely e-file Extension Form 8868 and receive an automatic 6-month extension through our quick and easy process.

With the Form 8868 app, you can e-file IRS Form 8868 from your tablet and get instantly approved for 6 more months to file. Get extra time to file your tax-exempt returns with all the security and ease from Tax990 - now available on the go with our mobile app!

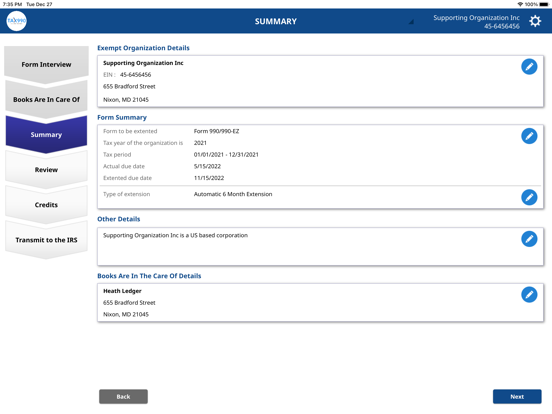

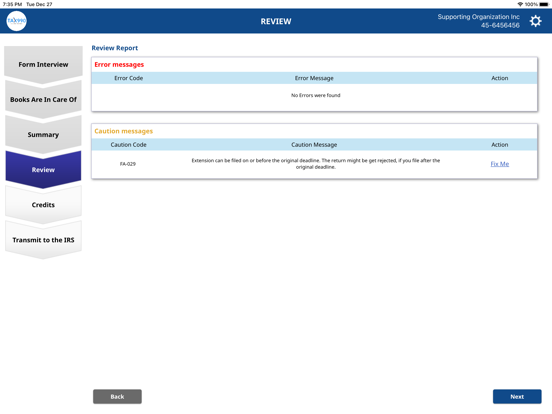

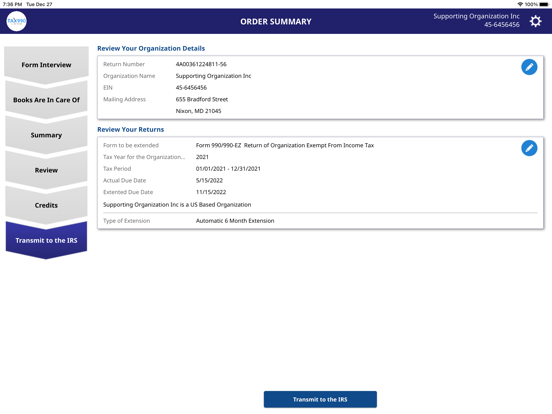

Form 8868 guarantees your organization an automatic 6-month extension to file your tax-exempt information returns with the IRS. Start with your employer identification number (EIN) and a few other business details, enter the required basic details, review your form with the built-in audit check, and transmit to the IRS. Once you’ve finished e-filing, you can view, download, or email your submitted return from your account. And if the IRS rejects your return, you can make corrections and re-transmit for FREE with us.

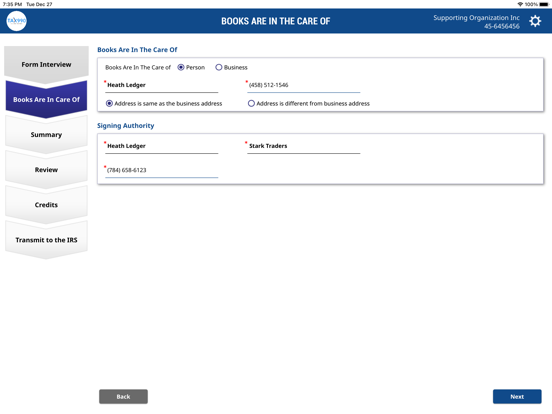

Steps to E-file:

Create an account and enter your organization’s details

Choose your tax year

Review form with our internal error check

Authorize and transmit to the IRS

So what are you waiting for? Ditch all that paper and lighten your load with the Form 8868 app. If you have any questions about e-filing Form 8868, please don’t hesitate to contact our friendly, US-based Support Team via phone: 704-684-4751 or email: support@Tax990.com

With the Form 8868 app, you can e-file IRS Form 8868 from your tablet and get instantly approved for 6 more months to file. Get extra time to file your tax-exempt returns with all the security and ease from Tax990 - now available on the go with our mobile app!

Form 8868 guarantees your organization an automatic 6-month extension to file your tax-exempt information returns with the IRS. Start with your employer identification number (EIN) and a few other business details, enter the required basic details, review your form with the built-in audit check, and transmit to the IRS. Once you’ve finished e-filing, you can view, download, or email your submitted return from your account. And if the IRS rejects your return, you can make corrections and re-transmit for FREE with us.

Steps to E-file:

Create an account and enter your organization’s details

Choose your tax year

Review form with our internal error check

Authorize and transmit to the IRS

So what are you waiting for? Ditch all that paper and lighten your load with the Form 8868 app. If you have any questions about e-filing Form 8868, please don’t hesitate to contact our friendly, US-based Support Team via phone: 704-684-4751 or email: support@Tax990.com

Show More

تحديث لأحدث إصدار 1.2.1

Last updated on 22/04/2024

الإصدارات القديمة

- Bug fixes and Stabilization improvements

Show More

Version History

1.2.1

22/04/2024

- Bug fixes and Stabilization improvements

E-File Tax Extension Form 8868 FAQ

انقر هنا لمعرفة كيفية تنزيل E-File Tax Extension Form 8868 في بلد أو منطقة محظورة.

تحقق من القائمة التالية لمعرفة الحد الأدنى من المتطلبات E-File Tax Extension Form 8868.

iPad

Requires iPadOS 14.0 or later.

E-File Tax Extension Form 8868 هي مدعومة على اللغات English