PNB ONE

Free

3.35for iPhone, iPad and more

Age Rating

PNB ONE Screenshots

About PNB ONE

PNB ONE is an amalgamation of various banking processes being delivered through single platform. This is an all in one application which allows you to transfer funds, view account statement, invest in term deposits, manage debit card & credit card and many other exclusive services at your fingertips.

Services Available / Features of PNB ONE

a) Interactive Interface

(i) Redesigned dashboard with more features available on the dashboard

(ii) Access all the accounts on the dashboard itself.

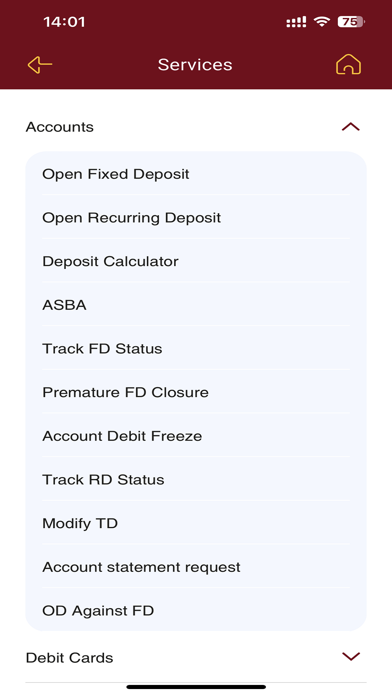

b) Accounts

(i) All accounts will be displayed in illustrative manner. ( Savings, Deposits, Loan, Overdraft, Current)

(ii) Detailed view of account statement

(iii) Check Balances

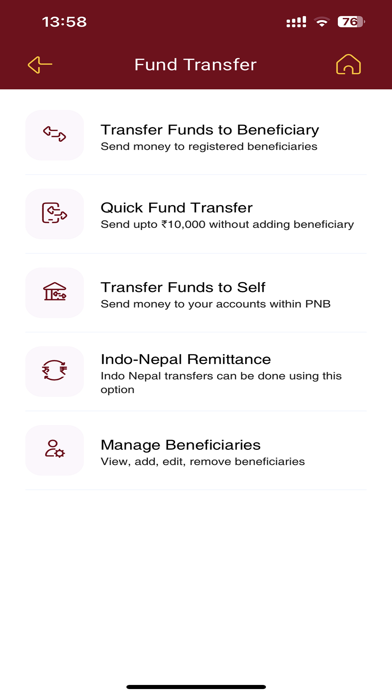

c) Transfer Funds:

(i) Regular Transfers - “Self” (for own accounts), “Within” (for PNB accounts) & “Other” (for non-pnb accounts) will be there.NEFT/IMPS/UPI for Interbank fund transfers.

(ii) Instant Transfers (without adding beneficiary) - IMPS using MMID and Quick Transfer without adding beneficiary.

(iii) Indo- Nepal Remittance

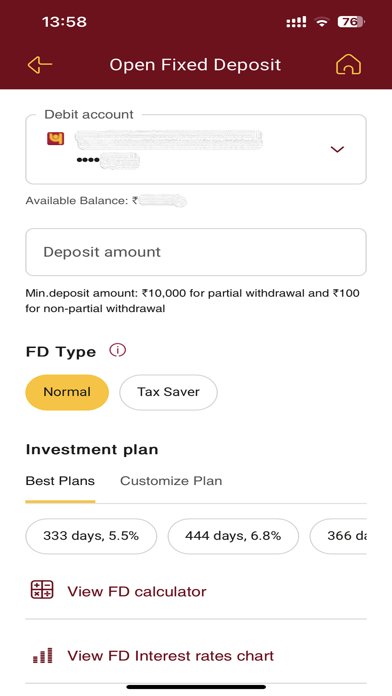

d) Invest funds

(i) Open a term deposit account

(ii) Mutual Funds

(iii) Insurance

e) Transactions

(i) My transactions will display all the recent transactions

(ii) My Favorite Payee will show list of recent payees

(iii) Schedule a transaction

(iv) Recurring transactions

f) Safe and secure

(i) Sign in much faster and simpler with your fingerprint

(ii) 2 factor authentication

(iii) Encryption

g) Manage Debit Card

(i) Apply for a new card

(ii) Update limits of ATM withdrawal, POS/ Ecomm transaction

(iii) Hotlist debit card

h) Manage Credit Card

(i) Link/De link Credit Card

(ii) Auto Payment Registration

(iii) Auto Payment De-Registration

(iv) Change card limit

(v) Statement on e-mail

(vi) Damaged card replacement

i) Unified Payment Interface (UPI)

(i) Send/ Collect money through UPI

(ii) Transaction History

(iii) Complaint Management

(iv) User Deregistration

j) Scan & Pay (BHARAT QR):

(i) Make Payment by scanning QR directly.

(ii) Link your cards once and make the payment directly from the account.

k) Pay Bills/Recharge:

(i) Register your biller pertaining to Mutual find, Insurance, Telecom, Electricity, DTH, credit card etc.

(ii) Pay bills directly to your registered biller.

l) Languages: Available in English and Hindi

m) Cheques

(i) Inquire Cheque Status

(ii) Stop Cheque

(iii) Request for Cheque book

(iv) View Cheque

n) M-Passbook

(i) View account statement of account

(ii) Download account statement in PDF for offline purposes.

o) Favourites

p) Value Added Services

(i) PAN/ Aadhar Registration

(ii) E-mail ID Updation

(iii) E statement registration

(iv) E-statement de registration

(v) MMID( used for IMPS)

(vi) Last 10 SMS

q) Complaint Service Management

(i) Raise a complaint/ Service Request

(ii) Track your request

(iii) Request history

Services Available / Features of PNB ONE

a) Interactive Interface

(i) Redesigned dashboard with more features available on the dashboard

(ii) Access all the accounts on the dashboard itself.

b) Accounts

(i) All accounts will be displayed in illustrative manner. ( Savings, Deposits, Loan, Overdraft, Current)

(ii) Detailed view of account statement

(iii) Check Balances

c) Transfer Funds:

(i) Regular Transfers - “Self” (for own accounts), “Within” (for PNB accounts) & “Other” (for non-pnb accounts) will be there.NEFT/IMPS/UPI for Interbank fund transfers.

(ii) Instant Transfers (without adding beneficiary) - IMPS using MMID and Quick Transfer without adding beneficiary.

(iii) Indo- Nepal Remittance

d) Invest funds

(i) Open a term deposit account

(ii) Mutual Funds

(iii) Insurance

e) Transactions

(i) My transactions will display all the recent transactions

(ii) My Favorite Payee will show list of recent payees

(iii) Schedule a transaction

(iv) Recurring transactions

f) Safe and secure

(i) Sign in much faster and simpler with your fingerprint

(ii) 2 factor authentication

(iii) Encryption

g) Manage Debit Card

(i) Apply for a new card

(ii) Update limits of ATM withdrawal, POS/ Ecomm transaction

(iii) Hotlist debit card

h) Manage Credit Card

(i) Link/De link Credit Card

(ii) Auto Payment Registration

(iii) Auto Payment De-Registration

(iv) Change card limit

(v) Statement on e-mail

(vi) Damaged card replacement

i) Unified Payment Interface (UPI)

(i) Send/ Collect money through UPI

(ii) Transaction History

(iii) Complaint Management

(iv) User Deregistration

j) Scan & Pay (BHARAT QR):

(i) Make Payment by scanning QR directly.

(ii) Link your cards once and make the payment directly from the account.

k) Pay Bills/Recharge:

(i) Register your biller pertaining to Mutual find, Insurance, Telecom, Electricity, DTH, credit card etc.

(ii) Pay bills directly to your registered biller.

l) Languages: Available in English and Hindi

m) Cheques

(i) Inquire Cheque Status

(ii) Stop Cheque

(iii) Request for Cheque book

(iv) View Cheque

n) M-Passbook

(i) View account statement of account

(ii) Download account statement in PDF for offline purposes.

o) Favourites

p) Value Added Services

(i) PAN/ Aadhar Registration

(ii) E-mail ID Updation

(iii) E statement registration

(iv) E-statement de registration

(v) MMID( used for IMPS)

(vi) Last 10 SMS

q) Complaint Service Management

(i) Raise a complaint/ Service Request

(ii) Track your request

(iii) Request history

Show More

What's New in the Latest Version 3.35

Last updated on Mar 28, 2024

Old Versions

Minor UI Enhancements

Show More

Version History

3.35

Mar 28, 2024

Minor UI Enhancements

3.34

Mar 19, 2024

Minor UI Enhancements

3.33

Feb 22, 2024

Minor UI Enhancements

3.32

Feb 13, 2024

minor UI enhancements

3.31

Feb 8, 2024

Minor UI Enhancements

3.29

Nov 30, 2023

Minor UI Enhancements

3.28

Nov 5, 2023

minor UI enhancements

3.27

Nov 3, 2023

minor UI enhancements

3.26

Oct 22, 2023

Minor UI Enhancements

3.25

Sep 11, 2023

Minor UI Enhancements

3.23

Aug 18, 2023

Minor UI Enhancements

3.21

Jul 4, 2023

Minor UI Enhancements

3.20

Jun 17, 2023

Minor UI Enhancements

3.19

Jun 4, 2023

Minor UI enhancements.

3.18

May 31, 2023

Minor UI Enhancements

3.17

May 13, 2023

Minor UI enhancements

3.16

May 11, 2023

Minor UI enhancements

3.15

Apr 17, 2023

Minor UI enhancements.

3.14

Apr 11, 2023

minor UI enhancements

3.12

Apr 1, 2023

Minor UI and Performance enhancements

3.11

Mar 24, 2023

Minor UI UX enhancements

3.10

Mar 15, 2023

Minor UI enhancement

3.9

Mar 3, 2023

Minor bug fixes

3.8

Feb 27, 2023

Minor Enhancements in the customer user interface.

3.6

Feb 19, 2023

Customer Can Now Experience Brand new User Interface.

PNB ONE FAQ

Click here to learn how to download PNB ONE in restricted country or region.

Check the following list to see the minimum requirements of PNB ONE.

iPhone

Requires iOS 12.1 or later.

iPad

Requires iPadOS 12.1 or later.

iPod touch

Requires iOS 12.1 or later.

PNB ONE supports English