TaxBandits: E-File 1099

File IRS Form 1099 online

Free

1.3.4for iPhone, iPad and more

8.3

5 Ratings

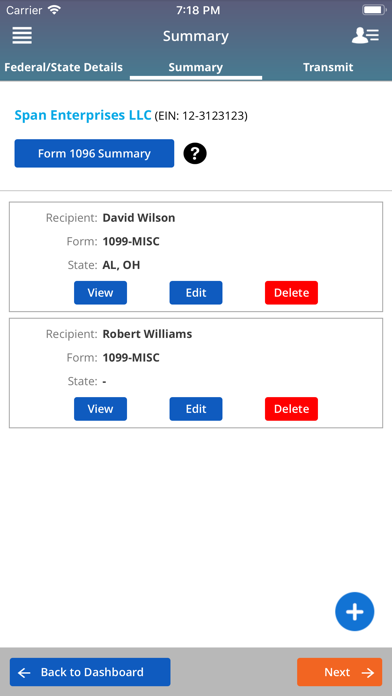

Span Enterprises LLC

Developer

69.2 MB

Size

08/01/2020

Update Date

Business

Category

4+

Age Rating

Age Rating

لقطات الشاشة لـ TaxBandits: E-File 1099

About TaxBandits: E-File 1099

E-File 1099 is a free app from TaxBandits allowing you to accurately & securely e-file your 1099 Forms with your mobile device!

E-file your Form 1099 in a matter of minutes anytime or anywhere! At TaxBandits, we take the stress out of tax filings by instantly transmitting your forms directly to the IRS.

How does E-File 1099 app help busy business owners?

SAVE TIME AND MONEY - FOREVER-FREE ACCOUNT - US-BASED CUSTOMER SUPPORT

As a business owner or entrepreneur, we understand that your time is immeasurably valuable. When you file using E-File 1099 app, you save both time and money. Instantly transmit your form directly to the IRS with our step-by-step interview style process no need to search for additional forms!

All of your information is saved in your TaxBandits account, and you can access it at any time. Copies of your completed returns are available in your account, and any in-progress forms can be accessed from your account as well. Since most tax forms are needed for at least 3 years for IRS purposes, your tax returns will never be deleted, so you access them at any time with E-File 1099 app.

"Our mobile application and web-based processing software, TaxBandits, are seamlessly integrated to create a user-friendly transition. Features offered on our web-based platform:

Instantly print and mail your submitted 1099 Forms from our web-based platform, or let us mail them for you! We’ll print your forms from our Rock Hill, SC office and we will send out your 1099 Forms to your recipients."

"DEADLINE

Recipient copies must be mailed out by: January 31st

Paper copies must be filed with the IRS by: February 28th

Electronic copies must be e-filed with the IRS by: March 31st"

"EXTENSIONS

Need more time to file your Form 1099? No worries! With TaxBandits, you can apply for an automatic 30-day extension with Form 8809 if you submit by the original due date."

"CORRECTIONS

File corrections to amend originally filed Form 1099. Correct recipient details and federal amounts on previously filed Form 1099 by simply re-filing the form with necessary indicators."

"STATE FILING

You can easily e-file 1099 federal and state taxes together. States in the Combined Federal/State Filing program (CF/SF) will have original and corrected 1099 Forms forwarded to the state by the IRS."

"INTEGRATIONS

When e-filing multiple 1099 Forms with TaxBandits, import your information directly from Xero® and QuickBooks®."

"ACTIVITY LOG

View various activities, such as added employees, logins, transmitted returns and other information, relating to your TaxBandits account."

"MULTI-USER ACCESS

Assign collaborators to assist in managing returns for your clients or business."

"US-BASED CUSTOMER SUPPORT

If you need help e-filing your 1099 Forms our experienced US-based customer support team is here for you! You can reach a friendly support team member Monday through Friday, 9:00 am to 6:00 pm EST, or by email 24/7. We offer assistance in English and Spanish by phone, live chat, and e-mail."

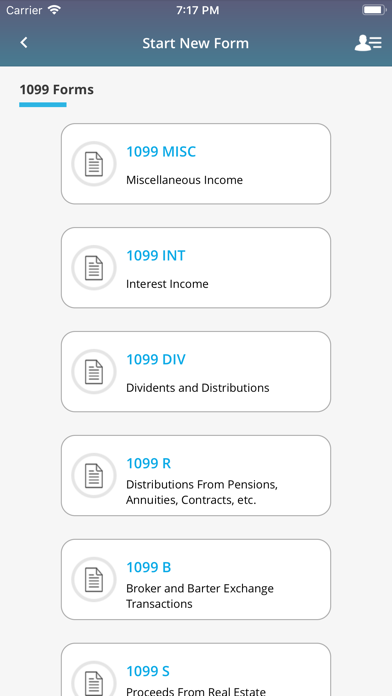

"WE ARE ALWAYS ADDING MORE FORMS

It started with supported e-filing for Form 1099-MISC, 1099-DIV, 1099-INT, 1099-R, 1099-B, and 1099-S so even more employers, payers, and other 1099 filers could e-file with our app. And stay tuned because other 1099 Forms will soon be available in this app as we continue to grow!"

4 STEPS TO E-FILE YOUR FORM 1099 WITH E-FILE 1099 APP

"STEP 1: Create an account.

STEP 2: Enter your business/payer information.

STEP 3: Enter your recipient/payee information.

STEP 4: Enter your Federal & State information

STEP 5: Review and transmit your return to the IRS."

Remember, you’re never alone when filing with E-File 1099 app. If you have any questions while completing your return, give us a call or send us an email. We are always happy to help! Call us today at 704-684-4751, or email us directly here support@TaxBandits.com.

E-file your Form 1099 in a matter of minutes anytime or anywhere! At TaxBandits, we take the stress out of tax filings by instantly transmitting your forms directly to the IRS.

How does E-File 1099 app help busy business owners?

SAVE TIME AND MONEY - FOREVER-FREE ACCOUNT - US-BASED CUSTOMER SUPPORT

As a business owner or entrepreneur, we understand that your time is immeasurably valuable. When you file using E-File 1099 app, you save both time and money. Instantly transmit your form directly to the IRS with our step-by-step interview style process no need to search for additional forms!

All of your information is saved in your TaxBandits account, and you can access it at any time. Copies of your completed returns are available in your account, and any in-progress forms can be accessed from your account as well. Since most tax forms are needed for at least 3 years for IRS purposes, your tax returns will never be deleted, so you access them at any time with E-File 1099 app.

"Our mobile application and web-based processing software, TaxBandits, are seamlessly integrated to create a user-friendly transition. Features offered on our web-based platform:

Instantly print and mail your submitted 1099 Forms from our web-based platform, or let us mail them for you! We’ll print your forms from our Rock Hill, SC office and we will send out your 1099 Forms to your recipients."

"DEADLINE

Recipient copies must be mailed out by: January 31st

Paper copies must be filed with the IRS by: February 28th

Electronic copies must be e-filed with the IRS by: March 31st"

"EXTENSIONS

Need more time to file your Form 1099? No worries! With TaxBandits, you can apply for an automatic 30-day extension with Form 8809 if you submit by the original due date."

"CORRECTIONS

File corrections to amend originally filed Form 1099. Correct recipient details and federal amounts on previously filed Form 1099 by simply re-filing the form with necessary indicators."

"STATE FILING

You can easily e-file 1099 federal and state taxes together. States in the Combined Federal/State Filing program (CF/SF) will have original and corrected 1099 Forms forwarded to the state by the IRS."

"INTEGRATIONS

When e-filing multiple 1099 Forms with TaxBandits, import your information directly from Xero® and QuickBooks®."

"ACTIVITY LOG

View various activities, such as added employees, logins, transmitted returns and other information, relating to your TaxBandits account."

"MULTI-USER ACCESS

Assign collaborators to assist in managing returns for your clients or business."

"US-BASED CUSTOMER SUPPORT

If you need help e-filing your 1099 Forms our experienced US-based customer support team is here for you! You can reach a friendly support team member Monday through Friday, 9:00 am to 6:00 pm EST, or by email 24/7. We offer assistance in English and Spanish by phone, live chat, and e-mail."

"WE ARE ALWAYS ADDING MORE FORMS

It started with supported e-filing for Form 1099-MISC, 1099-DIV, 1099-INT, 1099-R, 1099-B, and 1099-S so even more employers, payers, and other 1099 filers could e-file with our app. And stay tuned because other 1099 Forms will soon be available in this app as we continue to grow!"

4 STEPS TO E-FILE YOUR FORM 1099 WITH E-FILE 1099 APP

"STEP 1: Create an account.

STEP 2: Enter your business/payer information.

STEP 3: Enter your recipient/payee information.

STEP 4: Enter your Federal & State information

STEP 5: Review and transmit your return to the IRS."

Remember, you’re never alone when filing with E-File 1099 app. If you have any questions while completing your return, give us a call or send us an email. We are always happy to help! Call us today at 704-684-4751, or email us directly here support@TaxBandits.com.

Show More

تحديث لأحدث إصدار 1.3.4

Last updated on 08/01/2020

الإصدارات القديمة

- Bug Fixes

Show More

Version History

1.3.4

08/01/2020

- Bug Fixes

1.3.3

03/09/2019

- Bug Fixes

1.3.2

03/06/2019

- Now experience seamless performance in all versions of iPhone and iPad devices!

1.3.1

26/03/2019

- Bug Fixes

1.3.0

30/01/2019

- Minor Bug Fixes

1.2.9

24/01/2019

- Minor Bug Fixes & Performance Improvements

1.2.8

17/01/2019

- Tax Year 2018 Changes

- Minor Bug Fixes & Performance Improvements

- Minor Bug Fixes & Performance Improvements

1.2.7

12/07/2018

- Multi-factor Authentication

- Stabilization Improvements

- Stabilization Improvements

1.2.6

02/01/2018

- Stabilization Improvements

1.2.5

21/11/2017

- In addition to the forms 1099-MISC, 1099-INT and 1099-DIV, now you can e-file the forms 1099-R, 1099-B and 1099-S too..

- Several Stabilization Improvements

- Several Stabilization Improvements

1.2.4

05/10/2017

- In addition to the forms 1099-MISC, 1099-INT and 1099-DIV, now you can e-file the forms 1099-R, 1099-B and 1099-S too..

- Several Stabilization Improvements

- Several Stabilization Improvements

1.2.3

14/08/2017

- In addition to the forms 1099-MISC, 1099-INT and 1099-DIV, now you can e-file the forms 1099-R, 1099-B and 1099-S too..

- Several Stabilization Improvements

- Several Stabilization Improvements

1.2.2

11/08/2017

- In addition to the forms 1099-MISC, 1099-INT and 1099-DIV, now you can e-file the forms 1099-R, 1099-B and 1099-S too..

1.2.1

20/07/2017

- In addition to the forms 1099-MISC, 1099-INT and 1099-DIV, now you can e-file the forms 1099-R, 1099-B and 1099-S too..

1.2.0

23/05/2017

- In addition to the forms 1099-MISC, 1099-INT and 1099-DIV, now you can e-file the forms 1099-R, 1099-B and 1099-S too..

1.1.0

27/03/2017

- In addition to the form 1099-MISC, now you can e-file forms 1099-INT and 1099-DIV too..

1.0.0

15/03/2017

TaxBandits: E-File 1099 FAQ

انقر هنا لمعرفة كيفية تنزيل TaxBandits: E-File 1099 في بلد أو منطقة محظورة.

تحقق من القائمة التالية لمعرفة الحد الأدنى من المتطلبات TaxBandits: E-File 1099.

iPhone

Requires iOS 9.0 or later.

iPad

Requires iPadOS 9.0 or later.

iPod touch

Requires iOS 9.0 or later.

TaxBandits: E-File 1099 هي مدعومة على اللغات English